Embark on a journey through the realm of Cash Flow Budgeting for Entrepreneurs, where financial strategies intertwine with entrepreneurial dreams, promising a roadmap to prosperity.

Explore the nuances of cash flow management, from understanding its essence to practical budgeting techniques tailored for business growth.

Overview of Cash Flow

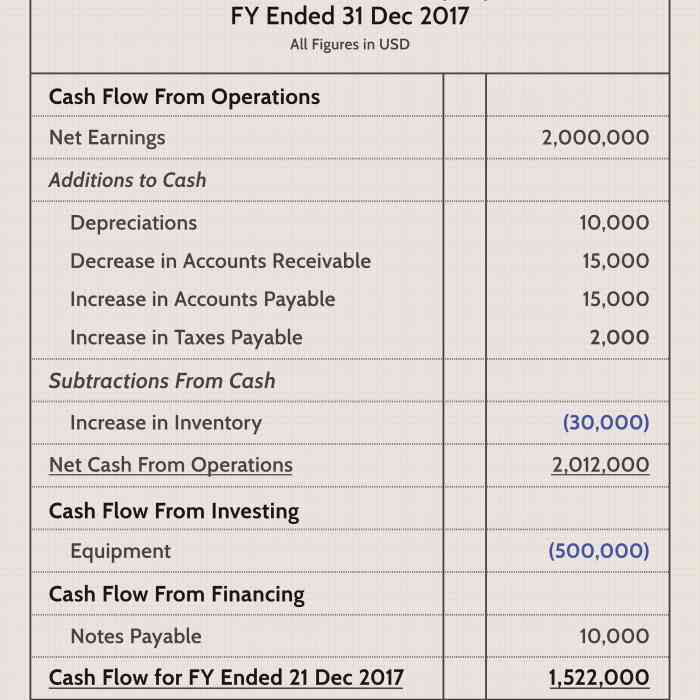

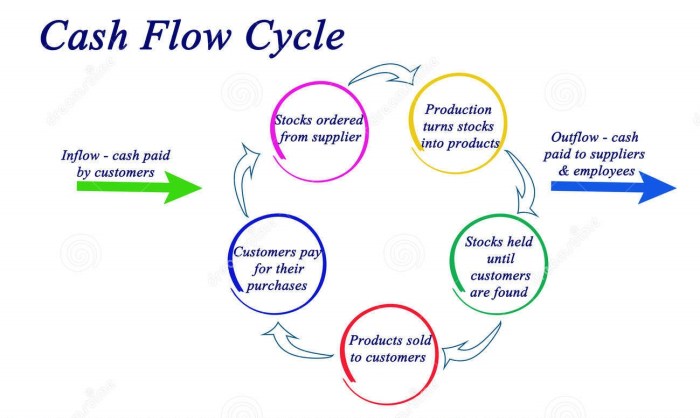

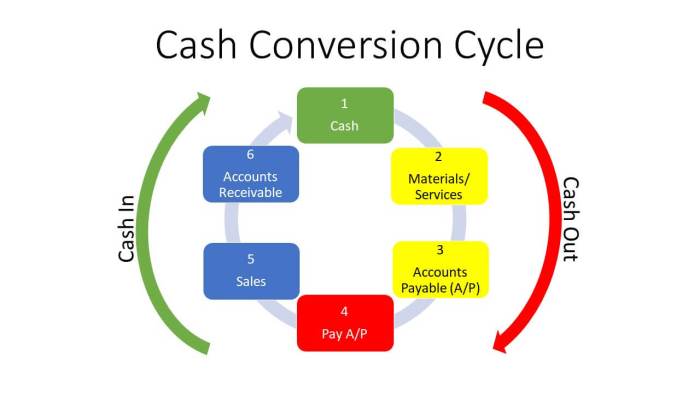

Cash flow is the movement of money in and out of a business. It represents the cash that is flowing in and out of a company during a specific period of time.

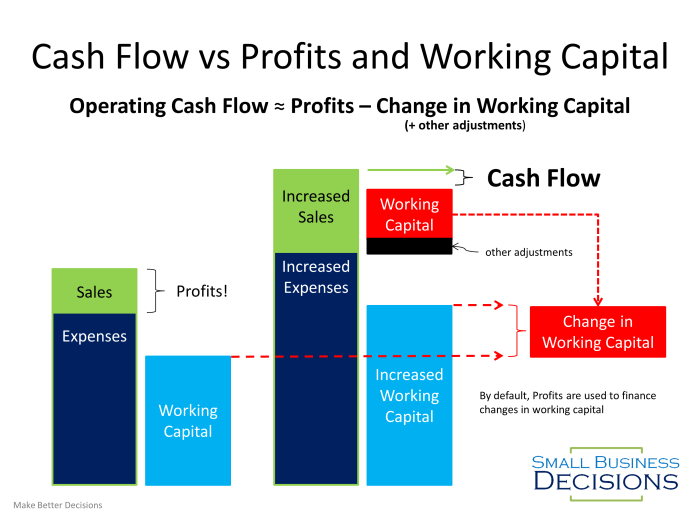

It is important to understand that cash flow is different from profit. While profit is the total revenue generated minus all expenses, cash flow focuses on the actual cash available to the business at any given time.

Effective management of cash flow is crucial for the sustainability and growth of a business. It ensures that the business has enough cash on hand to cover expenses, pay debts, and invest in future growth opportunities.

Differentiate between Cash Flow and Profit

Profit is the total revenue generated minus all expenses, while cash flow focuses on the actual cash available to the business at any given time.

Profit does not always equal cash flow, as profit includes non-cash items such as depreciation, while cash flow is a more accurate representation of the liquidity of the business.

It is possible for a business to be profitable but still face cash flow problems if there is a delay in receiving payments from customers or if there are high expenses that need to be paid immediately.

Importance of Managing Cash Flow Effectively

- Ensures the business can pay its bills on time

- Allows for timely payment of debts and loans

- Provides the ability to take advantage of growth opportunities

- Helps in planning for future investments and expenses

Components of Cash Flow Budgeting

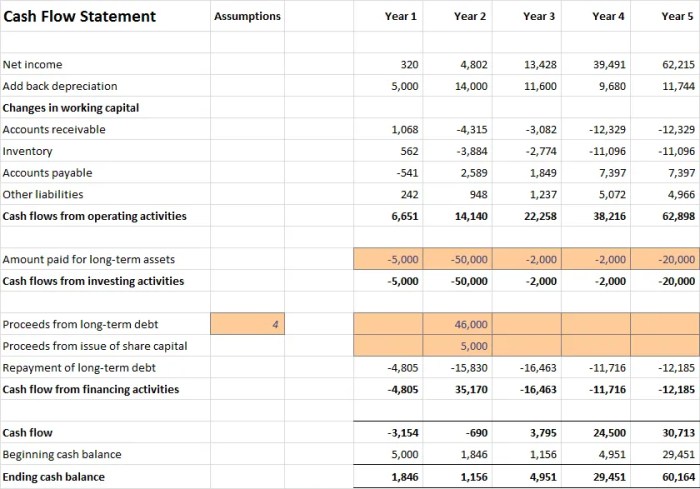

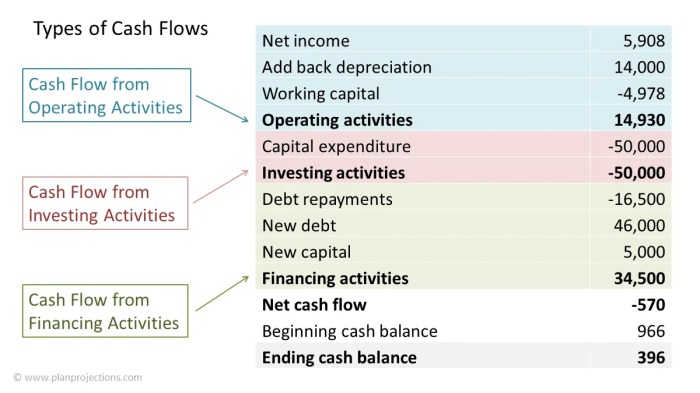

Cash flow budgeting involves several key components that are essential for managing the financial health of a business.

Impact of Sales Forecasts on Cash Flow Budgeting

Sales forecasts play a crucial role in cash flow budgeting as they provide an estimate of the revenue that a business expects to generate over a specific period. By accurately predicting sales, businesses can better plan for inflows of cash and allocate resources accordingly.

Consideration of Expenses in Cash Flow Budgeting

Expenses are a vital component of cash flow budgeting as they represent the outflows of cash that a business incurs to operate. It is important to carefully track and categorize expenses to ensure that they are accurately reflected in the budget. By forecasting and monitoring expenses, businesses can make informed decisions to manage their cash flow effectively.

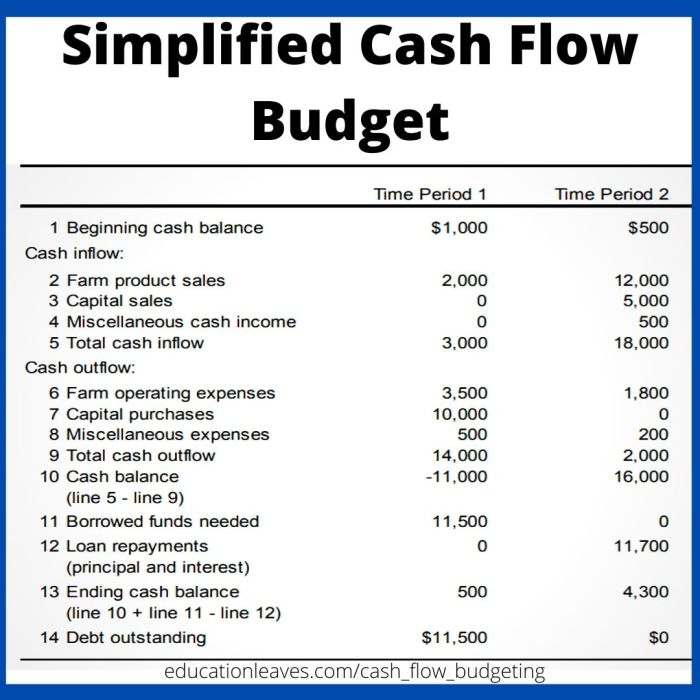

Creating a Cash Flow Budget

Creating a cash flow budget is essential for entrepreneurs to manage their finances effectively. By accurately estimating cash inflows and outflows, business owners can make informed decisions to ensure the sustainability of their operations.

Estimating Cash Inflows and Outflows

- Start by listing all sources of income for your business, including sales revenue, investments, loans, etc.

- Estimate the timing and amount of each cash inflow based on historical data or market trends.

- Next, identify all expenses such as rent, utilities, salaries, inventory purchases, and other operational costs.

- Break down expenses into fixed (constant) and variable (fluctuating) costs to accurately predict cash outflows.

- Use accounting software or spreadsheets to track and categorize inflows and outflows for better analysis.

Incorporating Seasonality or Irregular Income/Expenses

- Consider seasonal fluctuations in your industry and adjust your budget accordingly to reflect these changes.

- Create a separate section in your budget to account for irregular income or expenses that may not occur monthly.

- Set aside a contingency fund to cover unexpected costs or revenue shortfalls during lean periods.

- Regularly review and update your cash flow budget to adapt to changing market conditions and business needs.

Monitoring and Adjusting Cash Flow Budgets

Regularly monitoring cash flow is crucial for entrepreneurs to ensure that their business remains financially stable. By tracking actual cash flow against the budget, entrepreneurs can identify any discrepancies or areas where expenses may be exceeding projections. This allows for timely adjustments to be made to prevent cash flow problems before they escalate.

Importance of Monitoring Cash Flow

Monitoring cash flow on a regular basis provides insights into the financial health of the business. It helps entrepreneurs identify trends, anticipate potential cash shortages, and make informed decisions to optimize cash flow.

Tracking Actual Cash Flow

- Compare actual income and expenses to the budgeted amounts on a monthly basis.

- Utilize accounting software to generate cash flow reports for easy comparison.

- Identify any significant deviations and investigate the reasons behind them.

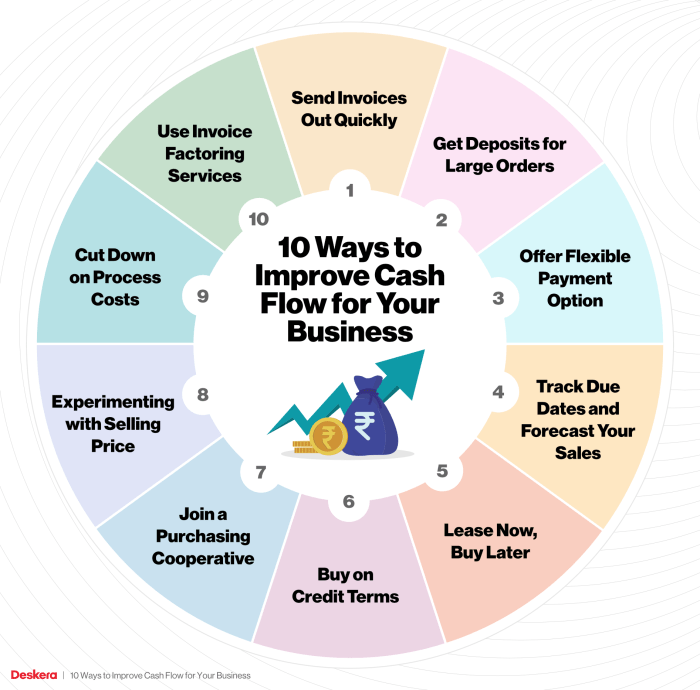

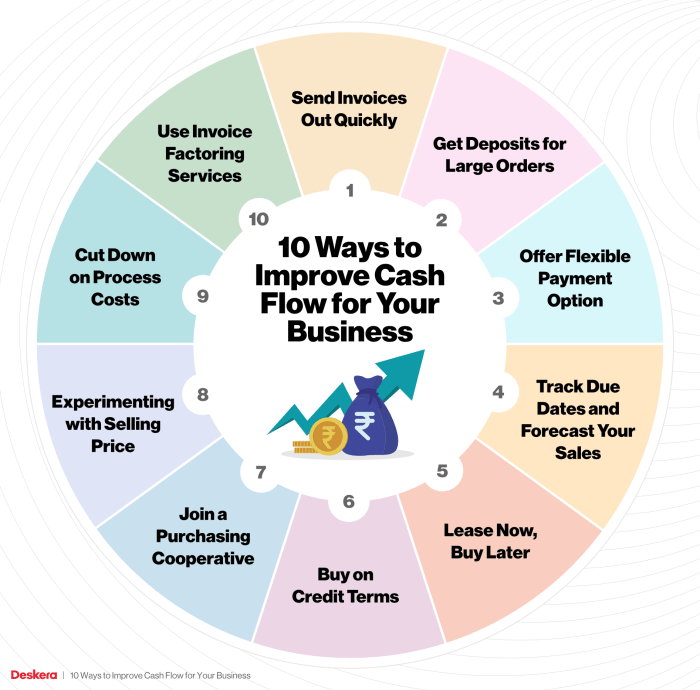

Strategies for Adjusting the Budget

- Reduce discretionary spending to free up cash flow in case of shortfalls.

- Explore opportunities to increase revenue through marketing campaigns or new product launches.

- Negotiate better payment terms with suppliers to improve cash flow.

- Consider refinancing loans or lines of credit to lower interest expenses.

In conclusion, mastering the art of cash flow budgeting can pave the way for entrepreneurial triumph, ensuring financial stability and calculated decision-making in the dynamic business landscape.

Common Queries

How is cash flow different from profit?

Cash flow represents the actual movement of money in and out of a business, while profit is the difference between revenue and expenses on the income statement.

Why is monitoring cash flow important?

Regularly tracking cash flow helps in identifying potential issues early, allowing for timely adjustments to maintain financial health.

How can seasonality be incorporated into a cash flow budget?

Adjusting cash flow projections based on seasonal fluctuations and predicting income and expenses during peak and off-peak periods is crucial for accurate budgeting.