Exploring the realm of Cash Flow in Real Estate Investments, this introduction sets the stage for a deep dive into the dynamics of financial success in property ventures. It unveils the critical role of cash flow in determining the sustainability and profitability of real estate investments, offering a glimpse into the intricate strategies and calculations that underpin this essential aspect of the industry.

As we navigate through the nuances of cash flow analysis, management, and the delicate balance between cash flow and property appreciation, readers are invited to embark on a journey filled with insights and actionable tips to enhance their real estate investment endeavors.

CASH FLOW

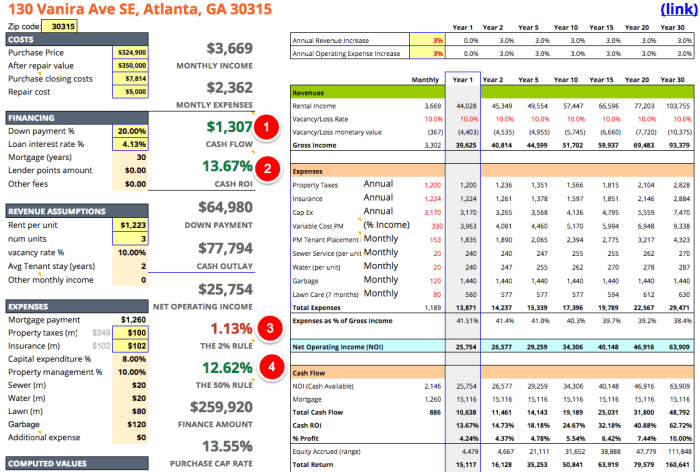

Cash flow in real estate investments refers to the amount of money generated from a property after deducting all expenses such as mortgage payments, property taxes, insurance, maintenance costs, and vacancies. It is a crucial metric that investors use to evaluate the profitability of their real estate assets.Positive cash flow is essential for real estate investments as it indicates that the property is generating more income than the expenses required to maintain it.

This excess cash flow can be reinvested into the property for improvements or used as passive income by the investor.In different types of real estate properties, cash flow can vary significantly. For example, residential rental properties tend to have stable cash flow with monthly rent payments, while commercial properties may have larger cash flow but can be more susceptible to economic fluctuations and vacancies.Consistent cash flow is vital for long-term real estate investment success as it provides financial stability and ensures that the property can cover its expenses and generate profits over time.

Investors rely on positive cash flow to build wealth, expand their real estate portfolio, and achieve their investment goals.

CASH FLOW ANALYSIS

When it comes to analyzing cash flow in real estate investments, there are several methods that investors can use to assess the financial performance of a property. Cash flow analysis is crucial for determining the profitability and sustainability of an investment over time.

Residential vs. Commercial Real Estate

- Residential Real Estate: Cash flow analysis for residential properties typically focuses on rental income, expenses such as property taxes, insurance, maintenance costs, and vacancy rates. Investors also consider factors like market demand, location, and potential for rental growth.

- Commercial Real Estate: In commercial real estate, cash flow analysis involves evaluating rental income from tenants, operating expenses, lease terms, and overall market trends. Investors may also factor in additional income streams such as parking fees or common area maintenance charges.

Calculating Cash Flow

To calculate cash flow from a real estate investment property, follow these steps:

- Start with the property’s gross rental income, which is the total income generated from rent.

- Subtract operating expenses such as property taxes, insurance, maintenance, utilities, and property management fees.

- Deduct any financing costs, including mortgage payments and interest.

- Consider other income sources like parking fees or laundry facilities, if applicable.

- The remaining amount is the property’s net operating income (NOI).

- Finally, subtract any capital expenditures or reserves for future repairs and maintenance to arrive at the property’s cash flow.

Impact of Rental Income and Expenses

Changes in rental income or expenses can significantly affect the cash flow of a real estate investment. For example:

Increasing rental income by raising rents or reducing vacancies can boost cash flow and overall profitability.

Conversely, unexpected expenses or a decrease in rental income due to market conditions can decrease cash flow and impact the property’s financial performance.

CASH FLOW MANAGEMENT

Effective cash flow management is crucial in real estate investments to ensure profitability and sustainability. By employing strategic approaches, investors can maximize cash flow, mitigate risks, and enhance the overall performance of their investment portfolio.Property management plays a significant role in maintaining consistent cash flow in real estate investments. A professional property manager can handle various tasks such as tenant screening, rent collection, property maintenance, and lease renewals.

By entrusting these responsibilities to a competent property management team, investors can minimize vacancies, reduce operational costs, and optimize rental income.

Maximizing Cash Flow Strategies

- Set competitive rental rates based on market analysis to attract and retain tenants.

- Implement cost-effective property maintenance practices to minimize expenses.

- Offer incentives for timely rent payments to ensure a steady cash flow.

- Diversify the real estate portfolio to spread risk and increase income streams.

Mitigating Risks Impacting Cash Flow

- Conduct thorough due diligence before acquiring a property to assess potential risks.

- Maintain adequate insurance coverage to protect against unforeseen events like property damage or liability claims.

- Create a financial buffer for unexpected expenses or periods of vacancy to safeguard cash flow.

- Regularly review and adjust rental rates to align with market trends and maximize income.

Reinvesting Cash Flow for Growth

- Consider upgrading existing properties to increase rental value and attract higher-paying tenants.

- Explore opportunities for acquiring additional properties to expand the investment portfolio and diversify assets.

- Invest in property improvements or renovations to enhance overall property value and generate higher returns.

- Allocate a portion of cash flow towards savings or reserves for future investment opportunities or emergencies.

CASH FLOW VS. APPRECIATION

When it comes to real estate investments, cash flow and property appreciation are two key factors that investors consider. While both are important, they serve different purposes and have different impacts on an investor’s overall strategy.

Differentiating Cash Flow and Property Appreciation

- Cash flow refers to the income generated from a property through rental payments, after deducting expenses such as mortgage payments, maintenance, and property management fees.

- Property appreciation, on the other hand, is the increase in the value of a property over time. This can be influenced by various factors such as market demand, location, and economic conditions.

Scenarios Prioritizing Cash Flow Over Appreciation

- Investors who prioritize cash flow are more focused on generating regular income to cover expenses and achieve a steady return on investment.

- Properties in high-demand rental markets with stable rental income are often preferred by investors prioritizing cash flow over appreciation.

Impact of Market Fluctuations on Cash Flow and Appreciation

- During market downturns, cash flow can provide a buffer for investors as rental income remains relatively stable, even if property values decrease.

- Property appreciation may be impacted during market fluctuations, leading to potential losses if the property value declines significantly.

Balancing Cash Flow and Appreciation in Investment Portfolio

- One strategy to balance cash flow and appreciation is to diversify the investment portfolio by including properties with different income profiles and growth potential.

- Reinvesting cash flow into property upgrades or acquiring new income-generating properties can help enhance both cash flow and appreciation over time.

In conclusion, the intricate dance between cash flow and property appreciation is a crucial element in the success of real estate investments. By mastering the art of strategic analysis and financial management, investors can unlock the full potential of their portfolios, paving the way for long-term growth and prosperity in the dynamic landscape of real estate.

Popular Questions

What is cash flow in real estate investments?

Cash flow in real estate investments refers to the net income generated from a property after deducting all expenses, including mortgage payments, property taxes, maintenance costs, and vacancies.

How can changes in rental income affect cash flow?

Increases in rental income can boost cash flow, while decreases or vacancies can lead to a decline in cash flow. It is essential to monitor and adjust rental rates to maintain a healthy cash flow.

What are some strategies for maximizing cash flow in real estate investments?

Strategies include conducting thorough market research, optimizing property management practices, minimizing vacancies, and exploring opportunities for rental income growth through property improvements.

Why is consistent cash flow important for long-term real estate investment success?

Consistent cash flow ensures that investors can cover ongoing expenses, build equity, and reinvest profits back into their real estate portfolios, fostering sustainable growth and financial stability over time.