Embark on a journey to enhance your business’s financial health with our guide on improving cash flow. From understanding the importance of positive cash flow to implementing effective strategies, this article covers all you need to know.

Learn how optimizing cash flow can lead to greater financial stability and support long-term business growth.

Understanding Cash Flow

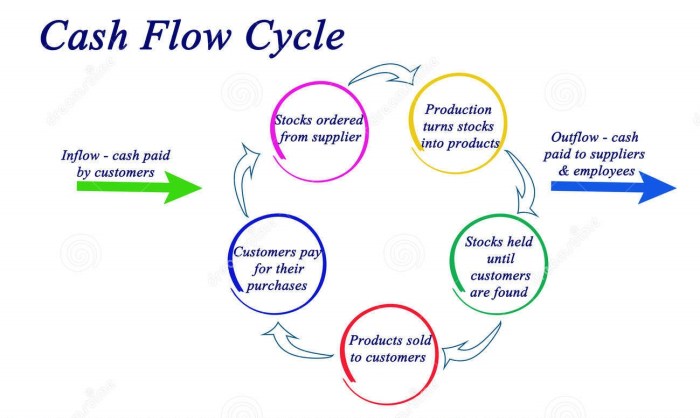

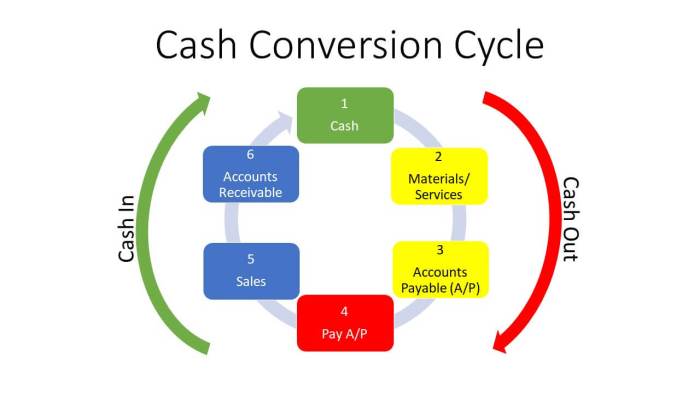

Cash flow is the movement of money in and out of a business, reflecting the overall financial health of the company. It is a crucial aspect for businesses to monitor as it determines the ability to pay bills, invest in growth, and cover expenses.

Components of Cash Flow

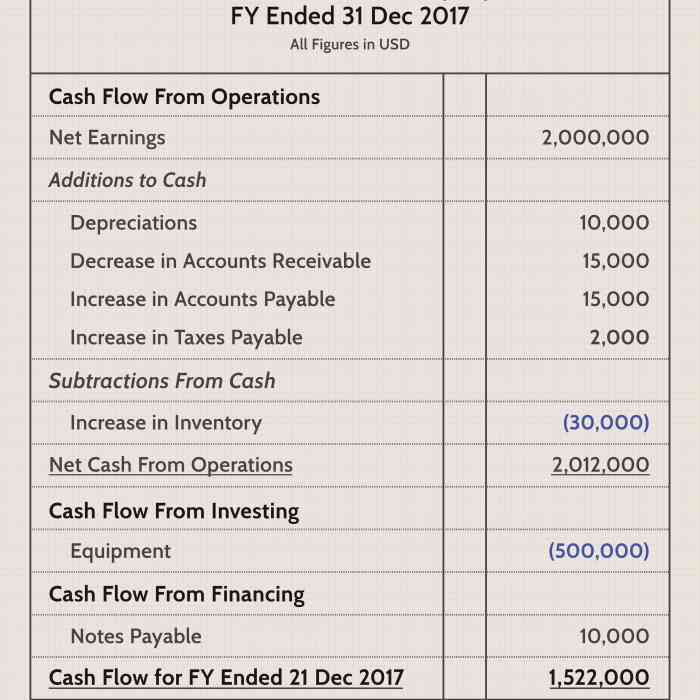

There are three main components of cash flow:

- Operating Activities: Cash flow from daily business operations, such as revenue from sales and expenses like salaries and rent.

- Investing Activities: Cash flow from investments in assets, like buying or selling equipment or property.

- Financing Activities: Cash flow from financing activities, including borrowing money, repaying loans, or issuing stock.

Positive vs. Negative Cash Flow

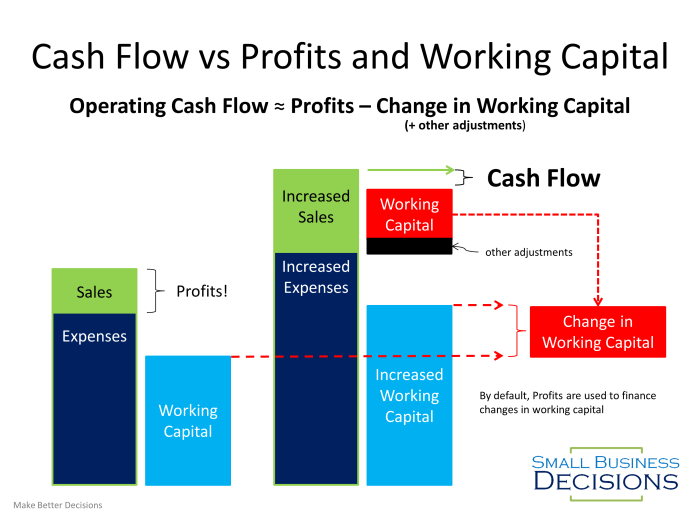

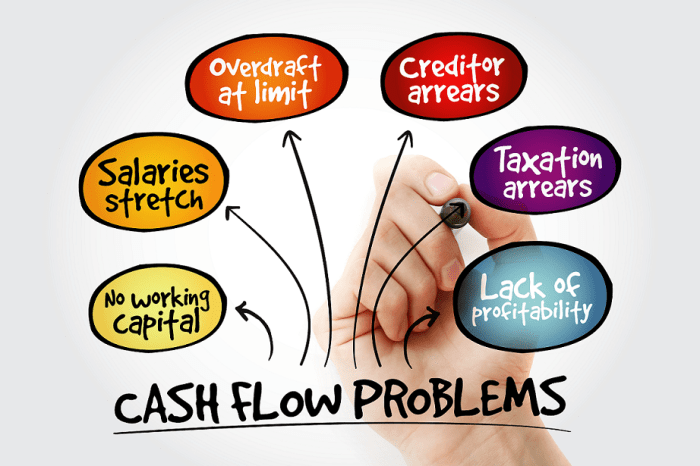

Positive cash flow indicates that a company is generating more money than it is spending, allowing for growth and stability. On the other hand, negative cash flow means the company is spending more than it is earning, which can lead to financial difficulties, debt, and potential bankruptcy.

Importance of Improving Cash Flow

Improving cash flow is crucial for the financial health and success of a business. By effectively managing the inflow and outflow of cash, businesses can experience a wide range of benefits that contribute to their overall stability and growth.Healthy cash flow is essential for businesses to meet their financial obligations, such as paying suppliers, employees, and other operating expenses on time.

By improving cash flow, businesses can avoid cash shortages and potential disruptions in their operations, ensuring smooth day-to-day functioning.Improved cash flow can also enhance financial stability by providing a cushion against unexpected expenses or economic downturns. With a steady stream of cash coming in, businesses are better equipped to weather financial challenges and uncertainties, reducing the risk of insolvency or bankruptcy.Furthermore, healthy cash flow can support business growth and sustainability in the long run.

With sufficient cash reserves, businesses can invest in new opportunities, expand their operations, and innovate their products or services. This not only helps businesses stay competitive in the market but also fosters long-term success and profitability.Overall, improving cash flow is essential for businesses to maintain financial stability, meet their obligations, and pursue growth opportunities. By effectively managing cash flow, businesses can secure their financial future and thrive in a competitive business environment.

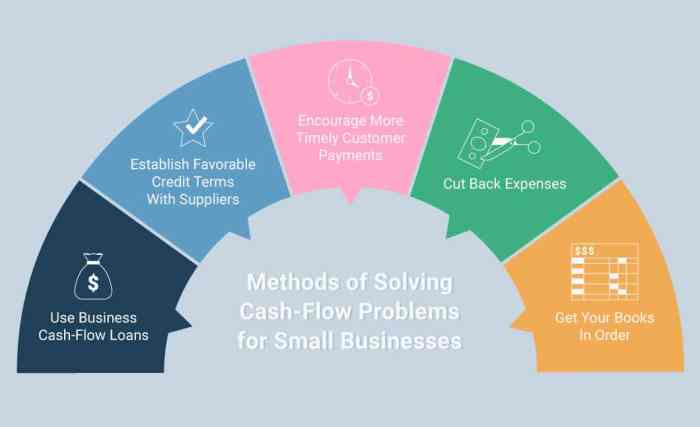

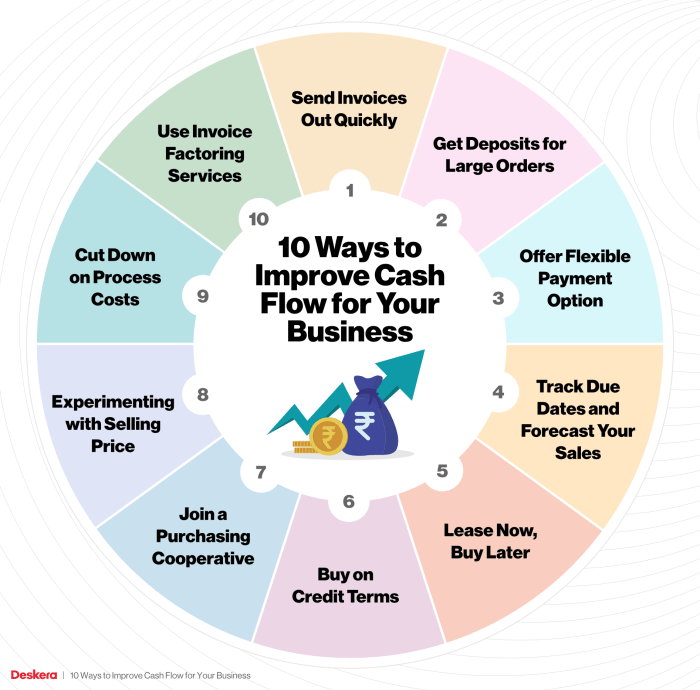

Strategies to Improve Cash Flow

Improving cash flow is crucial for the financial health of a business. By implementing various strategies, such as reducing expenses and increasing revenue, businesses can ensure a steady flow of cash to meet their financial obligations.

Efficient Inventory Management

Efficient inventory management plays a key role in improving cash flow. By optimizing inventory levels and reducing excess stock, businesses can free up cash that would otherwise be tied up in inventory. This allows businesses to have more working capital available for other operational needs.

Negotiating Better Payment Terms with Suppliers

Another effective strategy to improve cash flow is to negotiate better payment terms with suppliers. By extending payment terms or securing discounts for early payments, businesses can manage their cash flow more effectively. This can help in maintaining a healthy cash flow balance and ensuring timely payments to suppliers.

Cash Flow Forecasting

Cash flow forecasting is a crucial tool for businesses to predict the inflow and outflow of cash over a specific period. By forecasting cash flow, businesses can better manage their finances, identify potential cash shortages or surpluses, and make informed decisions to improve their financial health.

Process of Cash Flow Forecasting and Its Significance

Cash flow forecasting involves estimating the expected cash receipts and payments for a future period, typically on a monthly or quarterly basis. This process helps businesses anticipate their financial needs, plan for investments, and navigate through potential cash flow challenges.

- Start by analyzing historical cash flow data to identify patterns and trends.

- Consider factors that can impact cash flow, such as seasonality, economic conditions, and market trends.

- Project future cash inflows from sales, investments, and financing activities.

- Estimate cash outflows for expenses, purchases, debt payments, and other obligations.

- Review and adjust the forecast regularly to reflect any changes in the business environment.

Tools and Techniques for Accurate Cash Flow Forecasting

There are various tools and techniques available to help businesses create accurate cash flow forecasts:

- Using accounting software with cash flow forecasting features.

- Employing spreadsheet models to track and project cash flow data.

- Utilizing financial ratios and benchmarks to analyze cash flow trends.

- Implementing scenario analysis to assess different cash flow outcomes.

Tips for Creating a Reliable Cash Flow Forecast for a Business

Here are some tips to enhance the accuracy and reliability of your cash flow forecast:

- Update your forecast regularly to reflect current financial conditions.

- Involve key stakeholders in the forecasting process to gather diverse perspectives.

- Use conservative estimates for cash inflows and realistic projections for outflows.

- Consider different scenarios and prepare contingency plans for unexpected events.

- Monitor actual cash flow against forecasted figures to identify any discrepancies and adjust accordingly.

In conclusion, mastering the art of improving cash flow is key to ensuring your business’s financial success. By implementing the right strategies and maintaining a healthy cash flow, you pave the way for sustainable growth and prosperity.

FAQ Compilation

How can I improve cash flow quickly?

To improve cash flow quickly, consider offering discounts for early payments or renegotiating payment terms with suppliers.

Why is cash flow forecasting important?

Cash flow forecasting helps businesses predict future financial needs and make informed decisions to ensure financial stability.

What are some common mistakes to avoid when improving cash flow?

Avoiding overstocking inventory, delaying invoicing, and neglecting to follow up on outstanding payments are common mistakes to avoid when improving cash flow.