Exploring the key aspects of enhancing cash flow, this introduction sets the stage for a deep dive into effective financial management strategies. From understanding the importance of cash flow to implementing innovative revenue generation ideas, this guide offers valuable insights for businesses looking to improve their financial health.

As we delve further, we will uncover various techniques to boost cash flow, ranging from optimizing accounts receivable to exploring cost reduction methods. By the end, you’ll have a comprehensive understanding of how to increase cash flow and drive sustainable growth for your business.

CASH FLOW

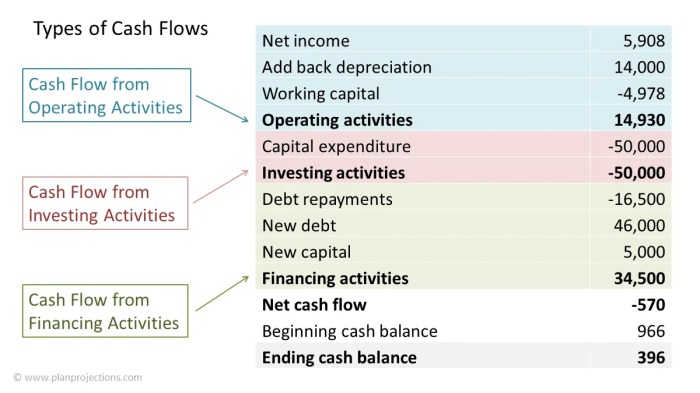

Cash flow in the context of business finances refers to the movement of money in and out of a business. It involves tracking the amount of cash coming into the business from sales, investments, or other sources, as well as the amount of cash going out to pay for expenses such as salaries, rent, and supplies.Effective management of cash flow is crucial for the financial health and stability of a business.

It ensures that the business has enough cash on hand to cover its operating expenses, debts, and other financial obligations. By monitoring and optimizing cash flow, businesses can avoid cash shortages, late payments, and financial distress.

Common Challenges Related to Cash Flow

- Seasonal fluctuations in revenue: Businesses may experience periods of high and low sales throughout the year, leading to cash flow challenges during slower seasons.

- Slow-paying customers: Delays in receiving payments from customers can disrupt cash flow and impact the business’s ability to meet its financial obligations.

- High overhead costs: Fixed expenses such as rent, utilities, and salaries can put a strain on cash flow, especially during periods of low revenue.

- Unforeseen expenses: Unexpected costs such as equipment repairs, legal fees, or inventory shortages can deplete cash reserves and disrupt cash flow.

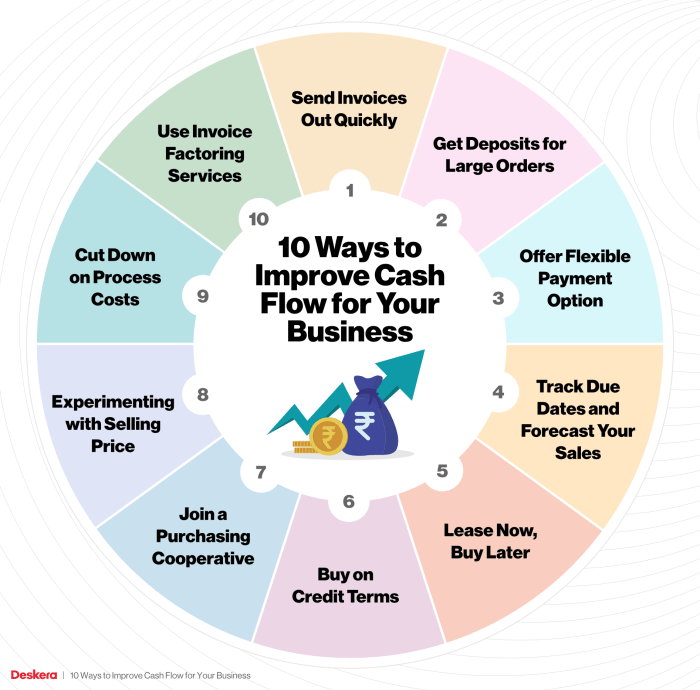

Strategies to Increase Cash Flow

Increasing cash flow is crucial for the success and sustainability of any business. It ensures that a company has enough funds to cover expenses, invest in growth opportunities, and weather any financial downturns. Here are some strategies to improve cash flow:

Optimizing Accounts Receivable

One effective way to boost cash flow is by optimizing accounts receivable. This involves ensuring that invoices are sent out promptly, following up on overdue payments, and offering incentives for early payments. By improving the efficiency of the accounts receivable process, businesses can shorten the time it takes to collect payments and increase the cash available for operations.

Cost Reduction Techniques

Cost reduction techniques are essential for improving cash flow by cutting unnecessary expenses. By implementing effective cost-saving measures, businesses can increase profitability and financial stability.

Negotiate Supplier Contracts

One way to reduce costs is by renegotiating contracts with suppliers to secure better pricing or terms. By leveraging long-term relationships and bulk purchasing power, businesses can lower expenses on raw materials or services.

Implement Energy Efficiency Measures

Reducing energy consumption through energy-efficient practices can lead to significant cost savings. Simple steps like switching to LED lighting, utilizing programmable thermostats, and optimizing equipment usage can lower utility bills and improve cash flow.

Outsource Non-Core Activities

Outsourcing non-core activities such as payroll processing, IT services, or customer support can help reduce overhead costs. By partnering with external service providers, businesses can focus on core operations while benefiting from cost-effective solutions.

Embrace Technology Solutions

Investing in technology solutions like automation software, cloud computing, and digital tools can streamline processes and reduce manual labor costs. By embracing innovation, businesses can enhance efficiency and cut expenses, ultimately boosting cash flow.

Revenue Generation Ideas

Increasing revenue streams is crucial for improving cash flow. By diversifying products or services and implementing effective marketing and sales strategies, businesses can boost their bottom line.

Diversifying Products or Services

Diversifying products or services can open up new revenue opportunities for businesses. By offering a range of products or services that cater to different customer needs, companies can attract a wider customer base and increase sales.

- Introducing complementary products or services that enhance existing offerings can encourage customers to make additional purchases.

- Exploring new markets or target demographics can help businesses tap into unmet needs and expand their customer base.

- Creating subscription or membership models can generate recurring revenue streams and improve cash flow stability.

Marketing and Sales Strategies

Effective marketing and sales strategies play a crucial role in driving revenue growth. By reaching out to target audiences and persuading them to make purchases, businesses can increase their sales and boost cash flow.

- Implementing targeted advertising campaigns that resonate with the target market can increase brand awareness and drive sales.

- Utilizing social media platforms and digital marketing channels can help businesses reach a wider audience and engage with customers effectively.

- Offering promotions, discounts, or loyalty programs can incentivize customers to make purchases and increase sales volume.

In conclusion, mastering the art of increasing cash flow is crucial for long-term business success. By implementing the strategies discussed, businesses can navigate financial challenges more effectively and pave the way for sustainable growth and profitability.

Top FAQs

How can cash flow impact a business’s financial health?

Cash flow directly influences a company’s ability to meet financial obligations, invest in growth opportunities, and sustain day-to-day operations.

What are some innovative ways to increase revenue streams?

Diversifying products or services, exploring new market segments, and leveraging digital marketing strategies are effective ways to boost revenue.

How can businesses effectively manage accounts receivable to improve cash flow?

Businesses can streamline invoicing processes, offer discounts for early payments, and implement credit policies to enhance accounts receivable management.