With Free Cash Flow vs Operating Cash Flow at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights.

Free Cash Flow and Operating Cash Flow play vital roles in financial analysis, providing unique perspectives on a company’s financial health. Let’s dive deeper into the nuances of these crucial metrics.

Free Cash Flow vs Operating Cash Flow

Free Cash Flow and Operating Cash Flow are both important metrics used in financial analysis to assess a company’s financial health. However, they differ in terms of what they measure and how they are calculated.

Free Cash Flow

Free Cash Flow is the amount of cash a company generates after accounting for capital expenditures necessary to maintain or expand its asset base. It is a measure of a company’s ability to generate cash for its investors and creditors.

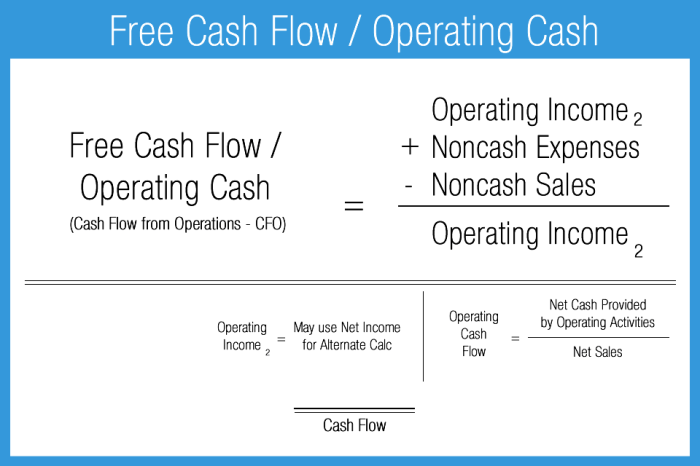

- Free Cash Flow = Operating Cash Flow – Capital Expenditures

Operating Cash Flow

Operating Cash Flow, on the other hand, measures the cash generated from a company’s core business operations. It does not take into account capital expenditures or other non-operating items.

- Operating Cash Flow = Net Income + Depreciation and Amortization – Changes in Working Capital

Importance in Financial Analysis

Both Free Cash Flow and Operating Cash Flow are crucial in financial analysis as they provide insights into a company’s financial performance and sustainability. Free Cash Flow indicates how much cash is available for debt repayment, dividends, share buybacks, and other investments. Operating Cash Flow, on the other hand, shows how well a company’s core operations are generating cash.

Comparison in Evaluating Financial Health

While Operating Cash Flow focuses on the cash generated from day-to-day operations, Free Cash Flow takes into account the capital expenditures needed to maintain or grow the business. Therefore, Free Cash Flow provides a more accurate picture of a company’s ability to generate cash and fund future growth, making it a more comprehensive measure of financial health.

Cash Flow

In a business context, Cash Flow represents the movement of money into and out of a company. It is a crucial metric that shows how much cash is generated and utilized by a business over a specific period.

Cash Flow is significant for a company’s financial performance as it indicates its ability to meet its financial obligations, invest in growth opportunities, and generate returns for shareholders. It provides insights into the company’s liquidity, operational efficiency, and overall financial health.

Types of Cash Flow

- Operating Cash Flow: This type of Cash Flow represents the cash generated or used in the normal course of business operations, including revenue and expenses.

- Investing Cash Flow: This category involves cash flows related to investments in assets such as property, plant, equipment, or securities.

- Financing Cash Flow: Financing Cash Flow includes cash flows from activities such as issuing or repurchasing stock, paying dividends, and borrowing or repaying loans.

The relationship between Cash Flow and profitability in a company is vital. While profitability indicates the company’s ability to generate earnings, Cash Flow ensures that those earnings translate into actual cash inflows. A company can be profitable but face cash flow issues if it fails to manage its operating, investing, and financing activities effectively.

In conclusion, Free Cash Flow and Operating Cash Flow are indispensable tools in assessing a company’s financial well-being and performance. Understanding the distinctions and applications of these metrics is key to making informed investment decisions and strategic business moves.

Essential FAQs

What is the main difference between Free Cash Flow and Operating Cash Flow?

Free Cash Flow represents the cash available for distribution to all stakeholders after all expenses and investments are accounted for, while Operating Cash Flow focuses on the cash generated from a company’s core operations.

How are Free Cash Flow and Operating Cash Flow calculated?

Free Cash Flow is derived by subtracting capital expenditures from operating cash flow, whereas Operating Cash Flow is calculated by adjusting net income for non-cash items and changes in working capital.

Why are Free Cash Flow and Operating Cash Flow important in financial analysis?

These metrics provide insights into a company’s ability to generate cash, its operational efficiency, and financial flexibility, offering a comprehensive view of its financial health beyond traditional profit measures.