Embark on a journey into the realm of Cash Flow Management Tools, where efficiency meets precision in financial management. Dive into the world of software solutions designed to streamline cash flow processes and optimize business performance.

Explore the key aspects of cash flow management tools and their impact on modern businesses, paving the way for enhanced financial control and strategic decision-making.

CASH FLOW

Cash flow is a crucial aspect of financial management that involves tracking the movement of money in and out of a business. It represents the net amount of cash and cash-equivalents being transferred into and out of a company.

Positive Cash Flow Scenario

A positive cash flow scenario occurs when a business has more cash coming in than going out. This can happen when a company generates more revenue than its expenses, resulting in a surplus of cash that can be reinvested or used for growth opportunities.

Negative Cash Flow Scenario

Conversely, a negative cash flow scenario occurs when a business is spending more money than it is bringing in. This can lead to financial difficulties, inability to pay bills or debts, and ultimately, insolvency if not addressed promptly.

Importance of Managing Cash Flow

Effectively managing cash flow is vital for the sustainability and success of a business. It ensures that there is enough liquidity to cover operational expenses, investments, and unforeseen costs. By maintaining a healthy cash flow, businesses can seize growth opportunities, weather financial challenges, and enhance overall financial stability.

Cash Flow Management Tools

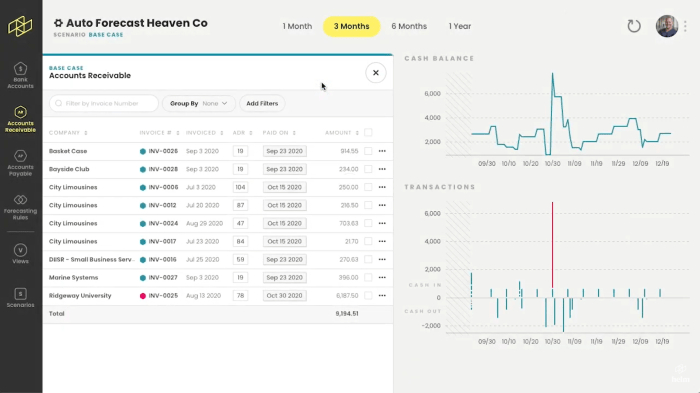

When it comes to managing cash flow effectively, there are various software tools available to help businesses streamline their financial processes. These tools range from basic spreadsheets to sophisticated cloud-based platforms, each offering unique features and benefits.

Popular Software Tools for Cash Flow Management

1. QuickBooks: A widely used accounting software that offers cash flow forecasting and reporting capabilities to track income and expenses.

2. Xero: Another popular accounting software that provides real-time cash flow insights and budgeting tools for businesses of all sizes.

3. FreshBooks: Ideal for freelancers and small businesses, FreshBooks offers invoicing, expense tracking, and cash flow monitoring features.

Cloud-Based Cash Flow Management Tools

Cloud-based cash flow management tools provide the flexibility of accessing financial data anytime, anywhere, and from any device with an internet connection. These tools offer real-time updates, collaboration features, and secure data storage, making it easier for businesses to manage their cash flow efficiently.

Automated Cash Flow Tools vs. Manual Methods

Automated cash flow tools streamline the process of tracking income and expenses, generating reports, and forecasting cash flow. These tools save time and reduce human error, allowing businesses to make informed financial decisions quickly.

In contrast, manual methods involve using spreadsheets or pen-and-paper to record financial transactions and analyze cash flow. While manual methods may work for small businesses with simple financial needs, they are prone to errors and can be time-consuming.

Budgeting and Forecasting

Budgeting and forecasting are essential components of effective cash flow management. By creating a budget, businesses can plan and control their expenses, ensuring that there is enough cash on hand to cover operational costs. On the other hand, accurate financial forecasting helps in predicting future cash flows, enabling businesses to make informed decisions and anticipate any potential cash flow issues.

The Role of Budgeting in Cash Flow Management

Budgeting serves as a roadmap for businesses, outlining expected income and expenses over a specific period. It allows companies to allocate resources efficiently, identify areas where costs can be reduced, and prioritize spending based on the available cash flow. By sticking to a budget, businesses can avoid overspending and maintain a healthy cash flow position.

The Importance of Financial Forecasting

Financial forecasting involves predicting future cash flows based on historical data, market trends, and other relevant factors. It helps businesses anticipate potential cash shortages or surpluses, enabling them to take proactive measures to address any issues. Accurate forecasting provides valuable insights for decision-making, such as when to invest in growth opportunities or when to cut costs to improve cash flow.

Tips for Creating Effective Budgets

- Start by analyzing historical financial data to understand past trends and patterns.

- Involve key stakeholders in the budgeting process to ensure buy-in and alignment with business goals.

- Set realistic and achievable financial goals that are in line with the overall business strategy.

- Regularly monitor actual performance against the budget and make adjustments as needed to stay on track.

- Use budgeting software or tools to streamline the process and improve accuracy.

Cash Flow Analysis

Conducting a cash flow analysis for a business is essential for understanding how money moves in and out of the company over a specific period. This analysis helps businesses assess their financial health, identify trends, and make informed decisions to improve cash flow management.

Key Metrics for Cash Flow Performance

- Operating Cash Flow: This metric reflects the cash generated from the core business operations of the company.

- Free Cash Flow: Free cash flow indicates the amount of cash available after all expenses and investments are accounted for.

- Cash Flow Margin: The cash flow margin is the ratio of operating cash flow to total revenue, showing how efficiently the company converts sales into cash.

- Cash Conversion Cycle: This metric measures the time it takes for a company to convert its investments in inventory and other resources into cash inflows.

Leveraging Cash Flow Analysis for Informed Decisions

Businesses can leverage cash flow analysis to make informed financial decisions by identifying potential cash flow issues, determining the best timing for investments or expenses, and setting realistic financial goals. By monitoring and analyzing cash flow regularly, businesses can adjust their strategies to optimize cash flow performance and ensure long-term financial stability.

In conclusion, Cash Flow Management Tools offer a transformative approach to financial management, empowering businesses to navigate the complexities of cash flow with confidence and agility. Embrace the power of automation and data-driven insights to unlock new possibilities for sustainable growth and prosperity.

FAQ Explained

How do cash flow management tools benefit businesses?

Cash flow management tools help optimize financial operations, improve decision-making, and enhance overall efficiency in managing cash flow.

Are cloud-based cash flow tools secure for business use?

Yes, cloud-based cash flow management tools offer robust security measures to protect sensitive financial data and ensure compliance with industry standards.

What distinguishes automated cash flow tools from manual methods?

Automated cash flow tools streamline processes, reduce human error, and provide real-time insights, whereas manual methods are often time-consuming and prone to inaccuracies.