Embark on the journey of Cash Flow Analysis, a vital aspect of financial management that unveils the essence of liquidity and financial health within businesses.

Explore the intricacies of cash flow versus profit, the components of a cash flow statement, and the methods of analysis that shape prudent decision-making processes.

Introduction to Cash Flow Analysis

Cash flow analysis is a vital tool in financial management that helps businesses track the inflow and outflow of cash within a specific period. It provides a clear picture of a company’s financial health and liquidity by focusing on actual cash transactions.

Significance of Cash Flow Analysis

Cash flow analysis is crucial in financial management as it helps businesses make informed decisions based on their actual cash position rather than just focusing on profits. By analyzing cash flow, companies can better manage their working capital, identify potential cash shortages, and plan for future investments.

Difference between Cash Flow and Profit

While profit represents the revenue earned minus expenses incurred over a period, cash flow focuses on the actual cash movements in and out of the business. A company can be profitable but still face cash flow issues if, for example, customers delay payments or if there are significant capital expenditures.

Importance of Understanding Cash Flow

- Ensures liquidity: Understanding cash flow helps businesses ensure they have enough cash on hand to meet their financial obligations, such as paying suppliers and employees.

- Supports growth: By analyzing cash flow, companies can identify opportunities to invest in growth initiatives or expansion without jeopardizing their financial stability.

- Prevents financial distress: Monitoring cash flow can help businesses anticipate and address potential cash shortages before they lead to financial distress or bankruptcy.

Components of Cash Flow Statement

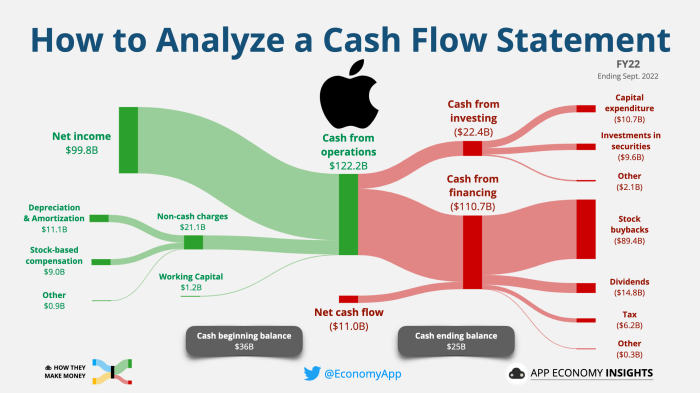

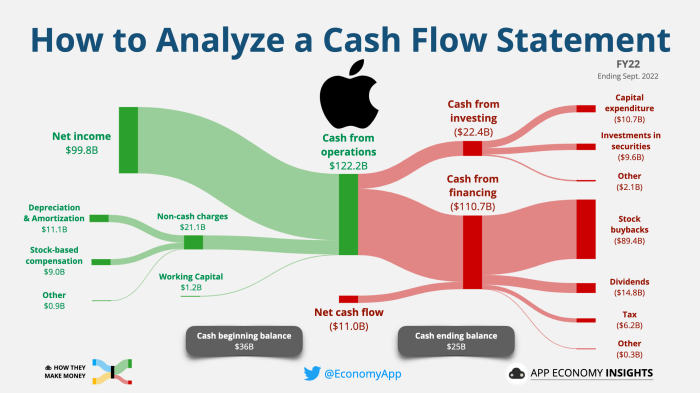

A cash flow statement is a financial statement that provides information about the cash inflows and outflows of a business during a specific period. It consists of three main components:

Cash Flow from Operating Activities

Cash flow from operating activities represents the cash generated or used by a company’s core business operations. It includes transactions related to revenue, expenses, and working capital. Positive cash flow from operating activities indicates that a company is able to generate enough cash to sustain and grow its operations.

Cash Flow from Investing Activities

Cash flow from investing activities reflects the cash flow resulting from the purchase and sale of long-term assets, such as property, plant, and equipment. It also includes investments in securities and other financial instruments. Understanding cash flow from investing activities helps stakeholders assess a company’s capital expenditure decisions and growth prospects.

Cash Flow from Financing Activities

Cash flow from financing activities represents the cash flow related to the company’s capital structure, such as issuing or repurchasing stock, issuing or repaying debt, and paying dividends. It provides insights into how a company raises and manages its capital. Positive cash flow from financing activities indicates that a company has a healthy financial position and can effectively manage its debt and equity.

Methods of Cash Flow Analysis

When it comes to analyzing cash flow, there are two main methods that can be used – the direct method and the indirect method. Both methods aim to provide insights into the cash flows of a business, but they differ in terms of how they approach the preparation of the cash flow statement.

Direct Method

The direct method of preparing a cash flow statement involves listing actual cash inflows and outflows from operating activities. This method directly reports cash receipts from customers, cash paid to suppliers, employees, and other operating expenses. For example, under the direct method, cash received from customers is listed as a positive cash inflow, while cash paid to suppliers is listed as a negative cash outflow.

Indirect Method

On the other hand, the indirect method starts with the net income from the income statement and makes adjustments to arrive at the cash flows from operating activities. Non-cash items such as depreciation, changes in working capital, and other adjustments are taken into account to reconcile net income to the actual cash generated or used in operations.

Advantages and Disadvantages

- Direct Method:

The direct method provides a clearer picture of cash flows from operating activities as it directly shows cash receipts and payments. It is easier to understand and analyze for stakeholders. However, it requires more detailed information and can be more time-consuming to prepare.

- Indirect Method:

The indirect method starts with the net income figure, which is readily available from the income statement. It is less detailed and easier to prepare compared to the direct method. However, it may not provide as clear a view of actual cash flows as the direct method.

Importance of Cash Flow Analysis for Decision Making

Cash flow analysis plays a crucial role in decision-making processes for businesses, providing valuable insights into the financial health and liquidity of a company.

Assessing Company’s Liquidity and Financial Health

By analyzing the cash flow statement, businesses can determine their ability to meet short-term financial obligations and cover operational expenses. A positive cash flow indicates that a company is generating more cash than it is spending, which is essential for sustainability and growth. On the other hand, a negative cash flow may signal financial trouble and the need for immediate attention to improve cash management.

Influencing Investment Decisions

Cash flow analysis also influences investment decisions by providing investors with valuable information about a company’s financial performance. Investors often look at metrics such as free cash flow and operating cash flow to assess the profitability and sustainability of a business. A strong cash flow position can attract potential investors and increase the confidence of existing shareholders.

Guiding Strategic Planning and Budgeting Processes

Moreover, cash flow analysis guides strategic planning and budgeting processes by helping businesses forecast future cash flows and allocate resources effectively. By understanding the cash inflows and outflows, companies can make informed decisions about investments, expansions, and debt repayments. This proactive approach enables businesses to mitigate risks and capitalize on growth opportunities.

In conclusion, Cash Flow Analysis acts as a compass guiding companies towards informed decisions, strategic planning, and sustainable growth, making it an indispensable tool in the realm of financial management.

Question & Answer Hub

How does cash flow analysis differ from profit analysis?

Cash flow analysis focuses on the movement of cash within a business, while profit analysis pertains to the overall profitability of a company, including non-cash items.

Why is understanding cash flow essential for businesses?

Understanding cash flow helps businesses assess their ability to meet financial obligations, plan for future investments, and ensure sustainable operations.

What role does cash flow analysis play in strategic planning?

Cash flow analysis provides insights into a company’s financial health, aiding in the formulation of strategic plans, budgeting decisions, and investment strategies.