With Negative Cash Flow Strategies at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling casual formal language style filled with unexpected twists and insights.

Understanding the impact of negative cash flow on businesses is crucial for navigating financial hurdles. This article delves into the reasons behind negative cash flow, its implications, and common strategies used in different industries.

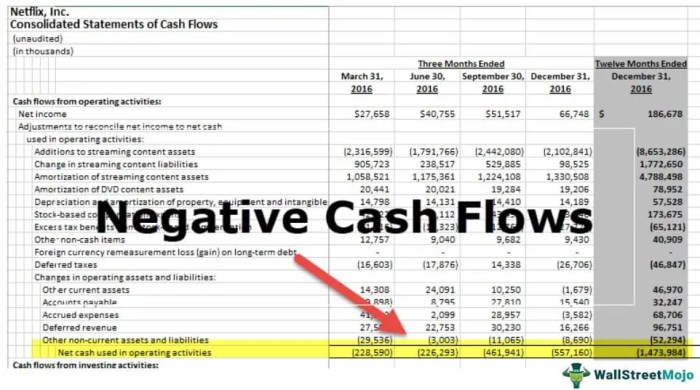

Negative Cash Flow Strategies

When a business experiences negative cash flow, it means that more money is going out of the company than coming in. This can have significant implications for the financial health and sustainability of the business.

Reasons for Negative Cash Flow

- High operating expenses: When a company has high overhead costs or spends excessively on day-to-day operations, it can lead to negative cash flow.

- Slow-paying customers: Delays in receiving payments from customers can strain a company’s cash flow, especially if the business relies heavily on timely payments.

- Seasonal fluctuations: Industries that experience seasonal variations in demand may struggle with negative cash flow during slow periods.

Implications of Sustained Negative Cash Flow

- Difficulty in meeting financial obligations: Negative cash flow can make it challenging for a company to pay its bills, suppliers, and other financial commitments on time.

- Increased borrowing costs: To cover cash flow gaps, a business may need to rely on borrowing, leading to additional interest expenses and financial strain.

- Risk of insolvency: Prolonged negative cash flow can ultimately put a company at risk of insolvency or bankruptcy if not effectively addressed.

Common Industries or Scenarios with Negative Cash Flow Strategies

- Start-ups: Many start-up companies operate with negative cash flow initially as they invest in growth and expansion, aiming for profitability in the long run.

- Real estate development: Real estate projects often experience negative cash flow during the construction phase before generating income from sales or rentals.

- R&D and innovation: Companies that heavily invest in research and development or innovation may face negative cash flow as they strive to bring new products or services to market.

Cash Flow

Cash flow is a crucial aspect of financial management that represents the movement of money in and out of a business or individual’s accounts. It is essential for assessing the financial health and sustainability of an entity.

Positive Cash Flow vs Negative Cash Flow

- Positive Cash Flow: This occurs when the incoming cash exceeds the outgoing cash within a specific period. It indicates that the entity has more money coming in than going out, which is generally seen as a healthy sign.

- Negative Cash Flow: On the other hand, negative cash flow happens when the outgoing cash surpasses the incoming cash. This situation can signify financial instability and may require immediate attention to avoid potential financial difficulties.

Cash Flow Analysis

Cash flow analysis involves examining the inflows and outflows of cash to evaluate the financial performance and liquidity of a business. It helps in decision-making by providing insights into the entity’s ability to meet its financial obligations and fund operations.

Components of a Cash Flow Statement

- Operating Activities: Cash flows from the primary business operations, including revenue and expenses.

- Investing Activities: Cash flows related to the purchase and sale of long-term assets, such as property, equipment, or investments.

- Financing Activities: Cash flows from activities like obtaining loans, issuing stock, or paying dividends to shareholders.

In conclusion, managing negative cash flow requires strategic planning and innovative approaches to ensure business sustainability. By exploring different strategies and understanding cash flow dynamics, companies can overcome financial challenges and thrive in the long run.

Popular Questions

What are some common reasons for negative cash flow?

Some common reasons include poor sales performance, high operating expenses, or excessive debt obligations.

How does negative cash flow impact a business?

Negative cash flow can lead to liquidity issues, hamper growth opportunities, and even threaten the survival of a company.

What are the key components of a cash flow statement?

The key components include operating activities, investing activities, and financing activities that show how money moves in and out of the business.