As Cash Flow vs Profit takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

When it comes to financial management, understanding the distinction between cash flow and profit is crucial for the success of any business. Let’s delve into the nuances of these two key metrics and explore why they play such vital roles in the business world.

CASH FLOW

Cash flow is the movement of money in and out of a business, including income from sales, expenses, and investments. It is different from profit as it focuses on the actual cash transactions rather than just the revenue and expenses reported on a financial statement.

Positive Cash Flow Scenario

A positive cash flow scenario occurs when a business generates more cash inflows than outflows. This means the business has enough cash to cover expenses, invest in growth, and build reserves for future needs.

Negative Cash Flow Scenario

On the other hand, a negative cash flow scenario happens when a business is spending more cash than it is earning. This can lead to financial difficulties, inability to pay bills, and even bankruptcy if not managed properly.

Importance of Managing Cash Flow

Managing cash flow effectively is crucial for the survival and success of a business. It ensures that the business can meet its financial obligations, take advantage of opportunities for growth, and weather any unexpected financial challenges that may arise.

CASH FLOW VS PROFIT

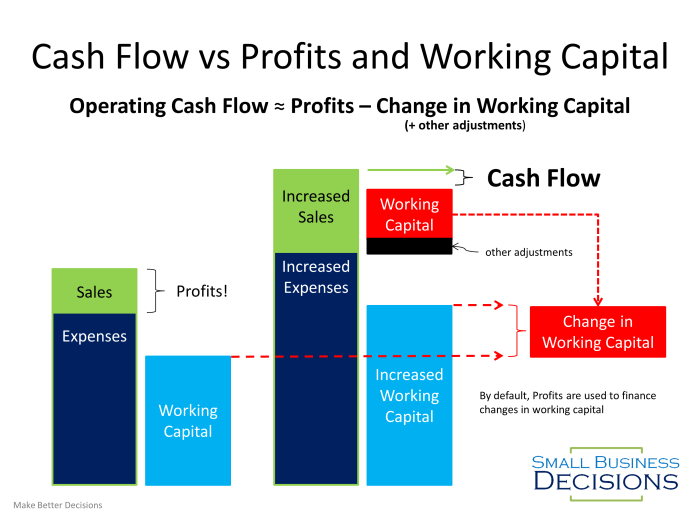

Cash flow and profit are two crucial financial metrics for a business, but they serve different purposes and provide distinct insights into the financial health of a company.Cash flow refers to the money coming in and going out of a business over a specific period, measuring the liquidity and operational efficiency of the business. On the other hand, profit is the financial gain obtained when the revenue earned exceeds the expenses incurred, indicating the overall financial performance of the business.

Differentiation in Timing and Concept

Cash flow is concerned with the actual movement of cash, focusing on the operational aspect of the business and ensuring that there is enough cash to cover expenses and investments. Profit, on the other hand, is a measure of financial performance over a specific period, showing how efficiently the business is generating revenue and managing expenses.

Calculation and Meaning

- Cash flow is calculated by adding cash receipts and subtracting cash payments, providing a real-time view of the business’s liquidity.

- Profit is calculated by deducting total expenses from total revenue, indicating the financial success of the business over a specific period.

Profitable Business with Cash Flow Issues

Businesses can be profitable but still face cash flow issues due to factors such as delayed payments from customers, high debt repayments, or large investments in inventory or equipment. In such cases, although the business is making a profit on paper, the lack of available cash can hinder day-to-day operations and growth opportunities.

In conclusion, navigating the complexities of cash flow and profit is essential for maintaining a healthy financial standing in any business. By grasping the differences and interplay between these two metrics, businesses can make informed decisions that drive long-term success and sustainability.

FAQ Summary

What is the main difference between cash flow and profit?

Cash flow refers to the actual movement of money in and out of a business, while profit is the financial gain after subtracting expenses from revenue.

Why is managing cash flow important for a business?

Managing cash flow effectively ensures that a business has enough liquidity to cover its expenses and invest in growth opportunities.

Can a business be profitable but still face cash flow issues?

Yes, a business can be profitable on paper but struggle with cash flow if there are delays in receiving payments or if there are high expenses that impact liquidity.