Beginning with Cash Flow Statement Template, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the intricacies of cash flow statement templates sheds light on the crucial role they play in financial management for businesses of all sizes.

CASH FLOW

Cash flow refers to the amount of money coming in and going out of a business over a specific period of time. It is a crucial component of financial statements as it provides insight into how well a company manages its money.

Importance of Cash Flow

Cash flow is essential for businesses for various reasons. Unlike revenue and profit, which are based on accrual accounting and can be manipulated, cash flow provides a more accurate picture of a company’s financial health. It helps businesses to:

- Ensure there is enough cash to cover expenses and debts

- Make important investment decisions

- Plan for future growth and expansion

Comparison with Revenue and Profit

While revenue and profit are important metrics for assessing a company’s performance, they do not provide a complete picture of its financial health. Revenue represents the total amount of sales generated, while profit is the difference between revenue and expenses. However, these figures can be misleading as they do not take into account the timing of cash inflows and outflows.On the other hand, cash flow focuses on the actual movement of cash within a business, providing a more accurate reflection of its liquidity.

It shows how much cash is available to meet obligations and fund operations, making it a more reliable indicator of financial stability.

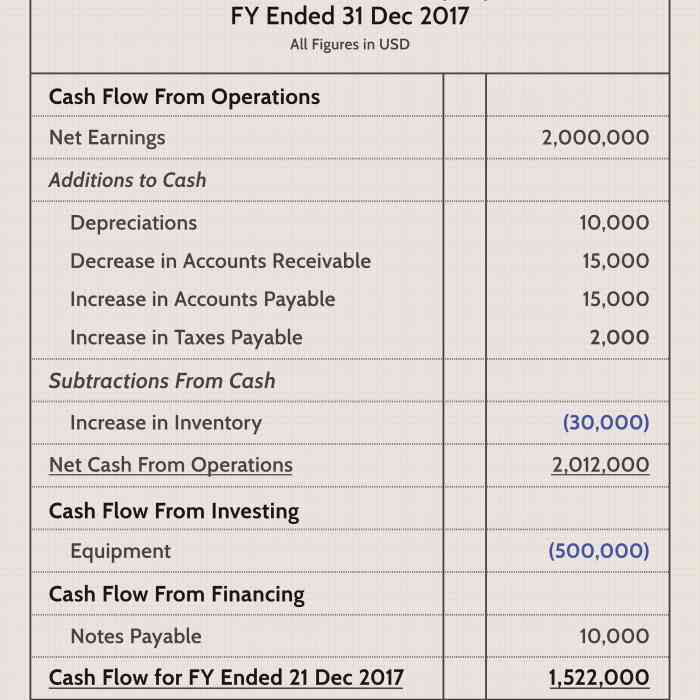

Cash Flow Statement Template

An essential financial document for businesses, the cash flow statement template provides a detailed overview of the cash coming in and going out of a company during a specific period. It helps analyze the liquidity, solvency, and overall financial health of a business.

Typical Sections Included in a Cash Flow Statement Template

- Operating Activities: This section includes cash flows from day-to-day business operations, such as sales, purchases, and expenses.

- Investing Activities: Here, cash flows related to investments in assets like property, equipment, or securities are recorded.

- Financing Activities: This section covers cash flows from activities like issuing stock, paying dividends, or taking out loans.

Examples of Different Formats or Layouts for Cash Flow Statement Templates

Direct Method:

The direct method lists actual cash inflows and outflows from operating activities, making it easier to understand for non-accountants.

Indirect Method:

The indirect method starts with net income and adjusts for non-cash items to arrive at the net cash provided by operating activities.

Vertical Analysis:

This format shows each cash flow item as a percentage of total cash flows, providing insights into the relative importance of each activity.

T-Account Format:

Similar to a T-account, this layout separates cash inflows and outflows into two columns, simplifying the visual representation of cash movements.

Operating Activities

Operating activities in a cash flow statement template capture the cash flows generated or used in the day-to-day operations of a business. These activities are crucial for assessing the financial health and sustainability of a company.

Examples of Operating Activities

- Revenue from sales of goods or services

- Payments to suppliers for inventory

- Salaries and wages paid to employees

- Receipts from customers for credit sales

- Interest received on loans or investments

Importance of Analyzing Operating Activities

Operating activities provide insights into how well a company is managing its core business operations to generate cash. By analyzing these activities, stakeholders can evaluate the efficiency of the company’s cash flow management, identify potential areas for improvement, and make informed decisions to enhance profitability and sustainability.

Investing Activities

Investing activities in a cash flow statement template refer to the cash flows related to the purchase and sale of long-term assets, investments, and other financial instruments. These activities are crucial in determining how a company is allocating its capital for long-term growth and sustainability.

Types of Investing Activities

- Purchase of property, plant, and equipment (PP&E): This involves buying assets like machinery, buildings, or land to support the company’s operations.

- Sale of investments: Selling stocks, bonds, or other securities can generate cash inflows for the company.

- Acquisition of other businesses: Buying another company can have a significant impact on cash flow, depending on the purchase price and financing structure.

Impact on Cash Flow

Investing activities can have a direct impact on a company’s cash flow. For example, heavy investments in PP&E can result in significant cash outflows in a given period, reducing the available cash for other uses. On the other hand, selling investments can provide a cash infusion, increasing the overall cash position.

Optimizing Investing Activities

Companies can optimize their investing activities to improve cash flow by carefully evaluating the expected returns on investment and balancing the need for growth with the available cash resources. By prioritizing projects with higher returns and managing capital expenditure efficiently, companies can ensure that their investing activities contribute positively to the overall cash flow position.

Financing Activities

Financing activities in a cash flow statement template document the inflows and outflows of cash related to obtaining or repaying capital. These activities typically involve transactions with creditors or investors that impact the company’s financial structure.

Examples of Financing Activities

- Issuing or repurchasing shares of stock

- Borrowing or repaying loans

- Paying dividends to shareholders

- Raising capital through bond issuance

Significance of Monitoring Financing Activities for Cash Flow Planning

Monitoring financing activities is crucial for cash flow planning as it helps businesses understand how their funding sources impact liquidity. By tracking these activities, companies can assess their ability to meet financial obligations, plan for future capital needs, and maintain a healthy balance between debt and equity.

In conclusion, mastering the art of utilizing cash flow statement templates can lead to improved financial decision-making and overall business success. Dive into the world of financial management with confidence armed with this essential tool.

Clarifying Questions

What is the importance of cash flow in financial statements?

Cash flow in financial statements provides a clear picture of how much actual cash a company is generating or using in its operations, offering valuable insights into its financial health.

How does a cash flow statement template differ from other financial statements?

A cash flow statement template focuses specifically on the movement of cash within a business, unlike income statements or balance sheets that provide different aspects of financial performance.

What are some common examples of operating activities in a cash flow statement template?

Operating activities typically include cash receipts from sales, payments to suppliers, salaries to employees, and other day-to-day business transactions.