Exploring the realm of Cash Flow Problems and Solutions, this introduction delves into the intricacies of financial management in a business setting, offering insights and strategies to navigate through challenging cash flow situations.

Providing a comprehensive overview of the impact of cash flow on a company’s financial well-being, this discussion aims to equip readers with practical knowledge and effective solutions to enhance cash flow management.

CASH FLOW

Cash flow is the movement of money in and out of a business, representing the amount of cash a company generates and spends during a specific period. It is a crucial financial metric that indicates the liquidity and operational efficiency of a business.

Positive Cash Flow

- Occurs when the incoming cash from sales, investments, or financing activities exceeds the outgoing cash for expenses, investments, and debt repayments.

- Indicates that a company has enough cash to cover its operational costs, invest in growth opportunities, and repay debts, leading to financial stability and growth.

Negative Cash Flow

- Occurs when the outgoing cash surpasses the incoming cash, resulting in a cash shortage to meet financial obligations, pay bills, or invest in the business.

- Can signal financial distress, operational inefficiencies, or unsustainable growth strategies if not managed effectively, leading to potential liquidity problems and insolvency.

Impact on Financial Health

- Cash flow is a vital indicator of a company’s financial health, reflecting its ability to meet short-term obligations, fund operations, and support growth initiatives.

- Positive cash flow ensures a company’s solvency, ability to seize opportunities, and weather economic downturns, while negative cash flow can jeopardize the business’s survival and sustainability.

- Effective cash flow management involves monitoring, forecasting, and optimizing cash flow to maintain financial stability, support strategic decisions, and enhance business resilience.

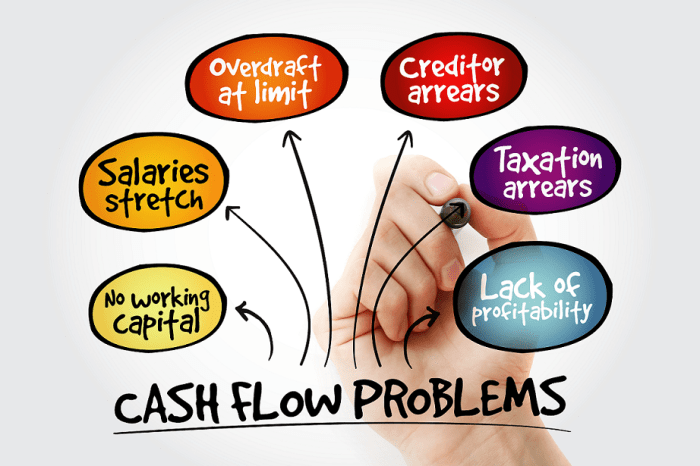

Common Causes of Cash Flow Problems

Cash flow problems are a common issue that many businesses face. Understanding the reasons behind these problems is crucial for finding effective solutions and ensuring the financial health of the business.

External Factors Impacting Cash Flow

External factors such as economic downturns can have a significant impact on a business’s cash flow. During periods of economic instability, consumers may reduce their spending, leading to a decrease in revenue for the business. This can result in cash flow problems as the business struggles to meet its financial obligations.

Poor Financial Management

Poor financial management is another common cause of cash flow problems. Inefficient budgeting, overspending, failure to track expenses, and lack of financial planning can all contribute to cash flow issues. Without proper financial management practices in place, businesses may find themselves facing cash flow shortages and struggling to stay afloat.

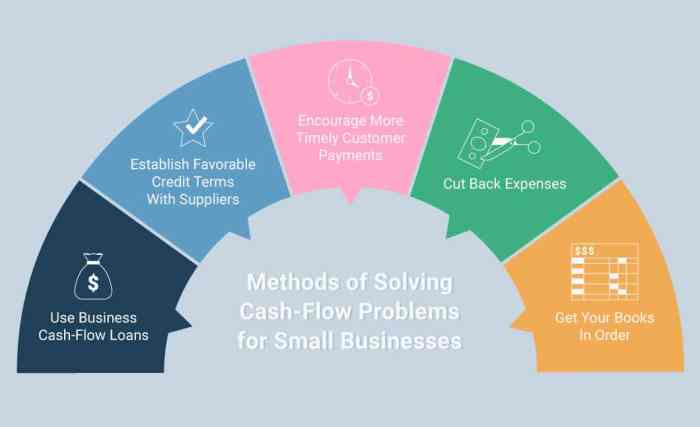

Solutions for Improving Cash Flow

Effective cash flow management is crucial for the financial health of a business. By implementing the right strategies, businesses can ensure a steady flow of cash and avoid potential cash flow problems. Let’s explore some solutions for improving cash flow:

Implementing Strict Budgeting and Forecasting

Budgeting and forecasting are essential tools for managing cash flow effectively. By creating a detailed budget that Artikels expected revenues and expenses, businesses can plan ahead and identify potential cash shortfalls. Regularly updating and monitoring the budget allows businesses to make informed decisions and adjust their operations to maintain a positive cash flow.

Renegotiating Payment Terms with Suppliers

One effective way to improve cash flow is by renegotiating payment terms with suppliers. By extending payment deadlines or negotiating discounts for early payments, businesses can better align their cash outflows with their cash inflows. This can help free up cash that can be used for other business needs, ultimately improving overall cash flow management.

Cash Flow Forecasting

Cash flow forecasting is a crucial process for businesses to predict future cash inflows and outflows, helping them make informed financial decisions and manage their resources effectively.

Creating a Cash Flow Forecast

Creating a cash flow forecast involves analyzing past financial data, sales projections, and upcoming expenses to estimate the amount of cash that will be available to the business in the future. It typically includes both short-term and long-term projections to provide a comprehensive view of the company’s financial health.

Tips for Accurately Predicting Future Cash Flows

- Regularly update your forecast: Continuously monitor and adjust your cash flow forecast based on actual financial data to ensure accuracy.

- Consider different scenarios: Develop multiple scenarios to account for potential changes in market conditions or unexpected events that could impact cash flow.

- Consult with experts: Seek advice from financial professionals or consultants to validate your forecast and ensure that it aligns with industry standards.

- Use cash flow forecasting tools: Utilize software or tools designed for cash flow forecasting to streamline the process and improve accuracy.

Benefits of Regular Cash Flow Forecasting

Regular cash flow forecasting offers several benefits for businesses:

- Improved decision-making: By having a clear understanding of future cash flows, businesses can make informed decisions regarding investments, expenses, and growth opportunities.

- Early identification of potential issues: Forecasting helps identify cash flow gaps or shortages in advance, allowing businesses to take proactive measures to address these issues.

- Better financial planning: With accurate cash flow forecasts, businesses can develop comprehensive financial plans that support long-term sustainability and growth.

Cash Flow Management Tools

Managing cash flow effectively is crucial for the financial health of a business. Utilizing the right tools and software can streamline the process and provide valuable insights for decision-making.

Popular Cash Flow Management Tools

- Xero: A cloud-based accounting software that offers features for invoicing, bank reconciliation, and cash flow tracking.

- QuickBooks Online: Another popular choice that provides cash flow forecasting, expense tracking, and financial reporting capabilities.

- Wave: A free accounting software that includes invoicing, receipt scanning, and cash flow monitoring tools.

Comparison of Cash Flow Management Solutions

| Tool | Key Features | Pricing |

|---|---|---|

| Xero | Invoicing, bank reconciliation, cash flow tracking | Starting at $20/month |

| QuickBooks Online | Cash flow forecasting, expense tracking, financial reporting | Starting at $25/month |

| Wave | Invoicing, receipt scanning, cash flow monitoring | Free |

Streamlining Cash Flow Management with Technology

Technology plays a crucial role in streamlining cash flow management processes by automating tasks, providing real-time insights, and improving accuracy. With the right tools in place, businesses can make informed decisions to optimize their cash flow and financial stability.

In conclusion, mastering the art of cash flow management is crucial for the success and sustainability of any business. By implementing the strategies and tools discussed, businesses can proactively address cash flow challenges and achieve financial stability.

General Inquiries

What are some unconventional ways to improve cash flow?

Exploring barter agreements with other businesses or implementing a subscription-based model can be innovative approaches to enhance cash flow.

How can seasonal fluctuations impact cash flow?

Seasonal businesses may experience irregular cash flow patterns, requiring careful planning and budgeting to manage cash effectively during peak and off-peak seasons.

Is it advisable to seek external financing to address cash flow problems?

While external financing can provide a temporary solution, businesses should prioritize sustainable cash flow management practices to prevent recurring issues.