Embark on a journey to enhance your business’s financial health with the essential Cash Flow Management Tips. Discover key strategies and insights to optimize cash flow and drive success.

Explore the significance of tracking cash flow, effective budgeting, and more as we delve into the world of managing cash flow for business growth.

CASH FLOW

Cash flow refers to the movement of money in and out of a business. It is crucial for businesses to manage their cash flow effectively to ensure they have enough cash on hand to cover expenses, invest in growth opportunities, and meet financial obligations.

Positive Cash Flow Scenario

A positive cash flow occurs when a business brings in more money than it spends. This allows the business to reinvest profits, pay off debts, and build a financial cushion for unexpected expenses.

Negative Cash Flow Scenario

Conversely, a negative cash flow happens when a business spends more money than it earns. This can lead to cash shortages, missed payments, and ultimately financial distress if not addressed promptly.

Difference Between Cash Flow and Profit

While profit is the total revenue generated minus expenses, cash flow focuses on the actual cash coming in and going out of the business. A business can be profitable but still experience cash flow issues if there are delays in receiving payments or if expenses are not managed efficiently.

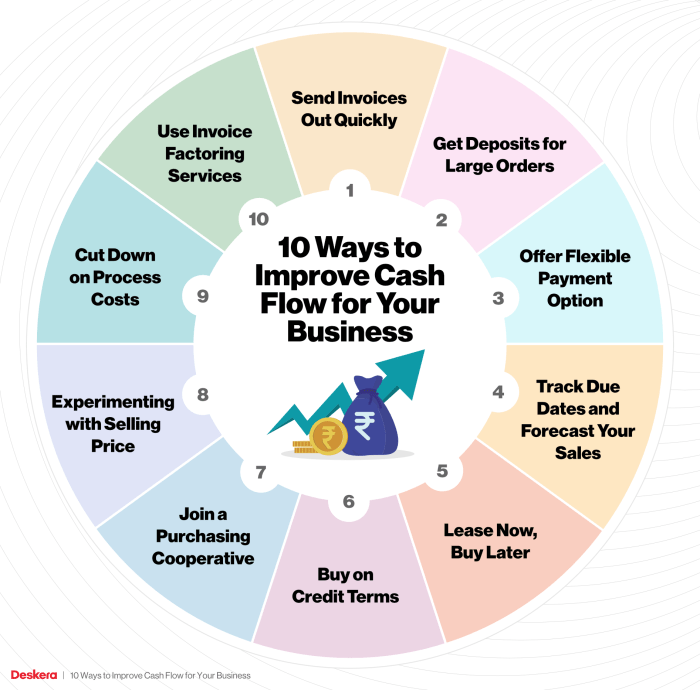

CASH FLOW MANAGEMENT TIPS

Effective cash flow management is crucial for the success of any business. By implementing the following strategies, businesses can improve their cash flow and ensure financial stability.

Track Cash Flow Regularly

It is essential to track cash flow regularly to have a clear understanding of the money coming in and going out of the business. By monitoring cash flow, businesses can identify any potential issues early on and take necessary action to address them.

Importance of Budgeting

Budgeting plays a key role in managing cash flow effectively. By creating a detailed budget, businesses can plan and allocate funds strategically, ensuring that there are enough resources to cover expenses and invest in growth opportunities.

CASH FLOW FORECASTING

Cash flow forecasting is the process of estimating the inflow and outflow of cash in a business over a certain period, usually on a monthly or quarterly basis. This financial management tool helps businesses predict their future cash position, identify potential cash shortages or surpluses, and make informed decisions to improve financial stability and performance.

Tips for Creating Accurate Cash Flow Projections:

- Utilize historical data: Analyze past cash flow patterns to identify trends and factors that may impact future cash flows.

- Consider different scenarios: Prepare multiple forecasts based on various assumptions to account for uncertainties and risks.

- Involve key stakeholders: Collaborate with department heads and finance team to gather insights and ensure realistic projections.

- Monitor regularly: Review and update cash flow forecasts regularly to reflect changes in the business environment and adjust strategies accordingly.

- Use cash flow forecasting software: Leverage technology to automate the process, improve accuracy, and generate detailed reports for better decision-making.

Benefits of Using Cash Flow Forecasting for Decision-Making:

- Anticipate cash needs: By forecasting cash flows, businesses can anticipate when they might need additional financing or when they can invest excess cash.

- Manage working capital: Cash flow forecasting helps businesses optimize their working capital by ensuring there is enough liquidity to cover operational expenses.

- Identify financial trends: Analyzing cash flow projections can reveal trends in revenue and expenses, allowing businesses to make strategic adjustments to improve profitability.

- Support strategic planning: Accurate cash flow forecasts provide valuable insights for long-term planning and help businesses align financial goals with overall strategic objectives.

- Enhance stakeholder communication: Transparent and reliable cash flow forecasts can improve communication with investors, lenders, and other stakeholders, building trust and confidence in the business’s financial management.

CASH FLOW STATEMENTS

Cash flow statements are crucial financial documents that provide insights into how money flows in and out of a business over a specific period. They consist of three main components: operating activities, investing activities, and financing activities.Operating activities include cash transactions related to the day-to-day operations of the business, such as revenue from sales and payments to suppliers. Investing activities involve cash flows from the purchase or sale of assets, like equipment or investments.

Financing activities include cash transactions related to borrowing, repaying loans, or issuing stock.Analyzing a cash flow statement involves looking at the net cash flow from each of these activities to determine if the business is generating enough cash to cover its expenses and investments. Positive cash flow indicates that the business is in a healthy financial position, while negative cash flow may signal financial trouble.

Using Cash Flow Statements for Financial Health

- Identifying Cash Flow Trends: By analyzing cash flow statements over multiple periods, businesses can identify trends in cash flow and make informed decisions about budgeting and financial planning.

- Managing Working Capital: Cash flow statements help businesses track their working capital and ensure they have enough liquidity to cover short-term obligations.

- Evaluating Investment Opportunities: Businesses can use cash flow statements to evaluate the potential return on investment for various projects or ventures.

- Forecasting Cash Needs: By analyzing past cash flow data, businesses can forecast their future cash needs and plan accordingly to avoid cash shortages.

In conclusion, mastering Cash Flow Management Tips is crucial for sustaining a thriving business. By implementing these strategies and techniques, you can navigate financial challenges with confidence and drive your business towards prosperity.

Query Resolution

How can I improve my business’s cash flow?

To enhance cash flow, focus on reducing expenses, increasing sales, and managing inventory efficiently.

Why is tracking cash flow regularly important?

Regular tracking helps identify trends, anticipate cash shortages, and make informed financial decisions.

What role does budgeting play in managing cash flow effectively?

Budgeting helps allocate resources wisely, control spending, and ensure cash is available when needed.