Embark on a journey through the financial landscape of startups with a focus on cash flow, exploring its significance and impact on business sustainability.

Delve into the strategies, challenges, and forecasting techniques that can help startups thrive in a dynamic economic environment.

Introduction to Cash Flow

In the context of startups, cash flow refers to the movement of money in and out of the business, including incoming revenues and outgoing expenses. It is a crucial aspect of financial management that directly impacts the sustainability and growth of a startup.

Importance of Monitoring Cash Flow

Monitoring cash flow is essential for startup success as it allows entrepreneurs to:

- Ensure there is enough cash to cover operational expenses and avoid financial distress.

- Identify potential cash shortages in advance and take proactive measures to address them.

- Evaluate the overall financial health of the business and make informed decisions for future growth.

Positive and Negative Cash Flow Scenarios

Positive cash flow occurs when a startup is bringing in more money than it is spending, resulting in a healthy financial position. On the other hand, negative cash flow occurs when a startup is spending more money than it is earning, leading to potential cash flow problems and the need for external financing.

Importance of Cash Flow Management

Effective cash flow management is crucial for the sustainability of any business, especially startups. It involves monitoring the flow of cash in and out of the company to ensure there is enough liquidity to cover operational expenses, debts, and other financial obligations. By managing cash flow effectively, startups can maintain financial stability and weather challenges that may arise.

Role of Cash Flow Management in Ensuring Business Sustainability

Cash flow management plays a key role in ensuring the long-term sustainability of a startup. By carefully monitoring cash inflows and outflows, businesses can identify potential cash shortages and take proactive measures to address them. This allows startups to avoid running out of funds unexpectedly and enables them to make informed financial decisions to support growth and development.

Benefits of Effective Cash Flow Management for Startups

- Improved financial planning and forecasting: By maintaining a clear picture of their cash flow, startups can better predict future financial needs and plan accordingly.

- Reduced financial risks: Effective cash flow management helps startups identify and address potential cash crunches before they become critical, reducing the risk of insolvency.

- Enhanced credibility with stakeholders: Consistent positive cash flow signals financial stability and responsible management, increasing credibility with investors, lenders, and other stakeholders.

Strategies for Optimizing Cash Flow in Startups

- Monitor cash flow regularly: Keep track of cash inflows and outflows on a daily, weekly, or monthly basis to identify trends and address any issues promptly.

- Manage accounts receivable and payable: Implement efficient invoicing and payment collection processes to accelerate cash inflows, while negotiating favorable payment terms with suppliers to optimize cash outflows.

- Control operating expenses: Evaluate and reduce unnecessary expenses to free up cash for essential business activities and investments.

- Build cash reserves: Set aside a portion of profits as cash reserves to cushion against unexpected expenses or revenue fluctuations.

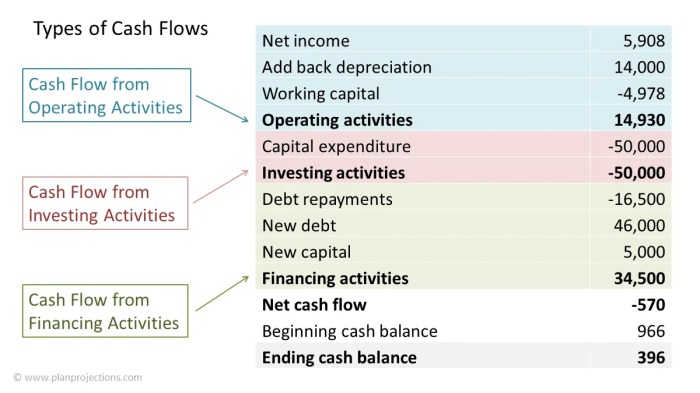

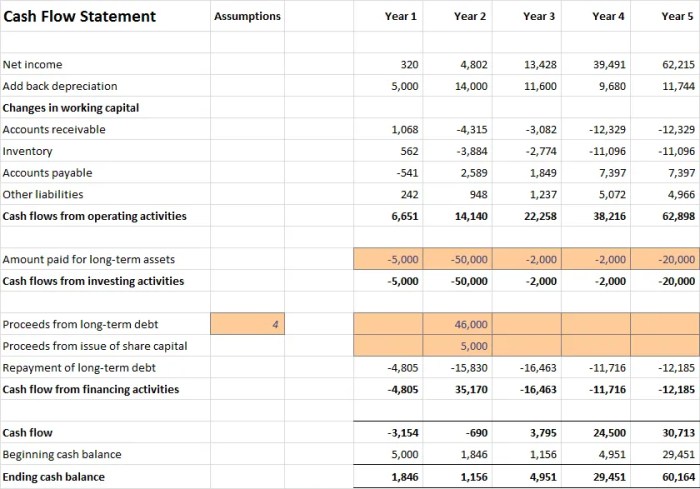

Components of Cash Flow Statement

Cash flow statements are essential financial documents that provide insights into the movement of cash in and out of a business. There are three key components of a cash flow statement: operating activities, investing activities, and financing activities. Each component plays a crucial role in determining the overall cash flow of a startup.

Operating Activities

Operating activities are the day-to-day functions of a business that generate revenue and incur expenses. These activities include cash transactions related to sales, purchases of inventory, payment of wages, and other operating expenses. For a startup, positive cash flow from operating activities indicates that the business is generating enough revenue to cover its operational costs. Conversely, negative cash flow may suggest inefficiencies in managing expenses or a decrease in sales.

Examples of transactions that fall under operating activities include:

- Receipts from customers for sales

- Payments to suppliers for inventory

- Wages and salaries paid to employees

- Interest received on loans

Investing Activities

Investing activities involve the purchase and sale of long-term assets, such as property, equipment, or investments. These activities can impact the future growth and profitability of a startup. Positive cash flow from investing activities may indicate that the business is expanding or making strategic investments for future growth. On the other hand, negative cash flow may suggest that the business is divesting assets or facing financial challenges.

Examples of transactions that fall under investing activities include:

- Purchase of equipment or machinery

- Sale of property or investments

- Loans made to other entities

- Proceeds from the sale of long-term assets

Financing Activities

Financing activities involve the inflow and outflow of cash related to the capital structure of a business. These activities include transactions with creditors and investors, such as borrowing money, repaying loans, issuing stock, or paying dividends. Positive cash flow from financing activities may indicate that the business is obtaining funding to support its operations or growth initiatives. Negative cash flow, on the other hand, may suggest that the business is repaying debt or distributing excess cash to shareholders.

Examples of transactions that fall under financing activities include:

- Issuance of common stock

- Repayment of long-term debt

- Payment of dividends to shareholders

- Borrowing money through loans or credit lines

Cash Flow Forecasting

Cash flow forecasting is a crucial aspect for startups as it helps in predicting the future financial health of the business. By estimating the amount of cash that will be coming in and going out of the company, startups can make informed decisions to ensure financial stability and growth.

Importance of Cash Flow Forecasting

- Anticipating Cash Needs: Cash flow forecasting allows startups to anticipate periods of low cash flow and plan accordingly to avoid cash shortages.

- Decision Making: Accurate forecasts help in making strategic decisions related to investments, expenses, and expansion plans.

- Investor Confidence: Investors often look at cash flow forecasts to assess the financial health and stability of a startup, influencing their investment decisions.

Creating Accurate Cash Flow Forecasts

- Utilize Historical Data: Startups can use past financial records to identify trends and patterns in cash flow, aiding in creating more accurate forecasts.

- Consider Different Scenarios: Account for various scenarios like best-case, worst-case, and most likely outcomes to prepare for unexpected changes in cash flow.

- Regular Review: Continuously review and adjust forecasts based on actual cash flow data to improve accuracy over time.

Tips for Improving Accuracy

- Monitor Expenses Closely: Keep a close eye on expenses to ensure they align with the forecasted cash outflows.

- Stay Updated: Stay informed about market trends, industry changes, and economic factors that can impact cash flow predictions.

- Use Cash Flow Management Tools: Implement software or tools that can help in tracking and analyzing cash flow data more efficiently.

Managing Cash Flow Challenges

Startups often face various cash flow challenges that can hinder their growth and sustainability. It is crucial for entrepreneurs to identify these challenges and implement effective strategies to overcome them.

Common Cash Flow Challenges for Startups

- Uneven Revenue Streams: Startups may experience irregular income, making it difficult to cover expenses consistently.

- High Operating Costs: Managing expenses such as rent, salaries, and inventory can strain cash flow, especially in the initial stages.

- Seasonal Demand: Fluctuations in customer demand throughout the year can impact cash flow management.

Strategies for Overcoming Cash Flow Challenges

- Monitor Cash Flow Closely: Regularly track income and expenses to identify potential issues early on.

- Implement Cost-cutting Measures: Look for areas where expenses can be reduced without compromising quality.

- Negotiate Payment Terms: Work with suppliers and clients to extend payment deadlines or arrange for partial payments to ease cash flow constraints.

Real-World Examples of Successful Cash Flow Management

- Buffer: The online budgeting tool managed to survive cash flow challenges by building a strong emergency fund and diversifying revenue streams.

- Zenefits: The HR software startup overcame cash flow difficulties by renegotiating vendor contracts and focusing on customer retention to improve cash flow.

Cash Flow vs. Profitability

Understanding the difference between cash flow and profitability is crucial for startups to effectively manage their finances. While profitability focuses on the overall financial health of a business, cash flow is more about the movement of money in and out of the company.

Cash Flow vs. Profitability in Startups

In startups, it is possible to be profitable but still face cash flow issues. This can happen when a company is making sales and generating revenue, indicating profitability, but struggles with collecting payments from customers in a timely manner or dealing with high expenses that drain cash reserves.

- Example 1: A tech startup develops a new software product and secures a big contract with a client, leading to profitability on paper. However, the client delays payments, causing a cash flow crunch that affects the company’s ability to pay suppliers or invest in growth.

- Example 2: A retail startup experiences a surge in sales during a holiday season, resulting in profitability due to high revenues. However, the need to restock inventory quickly and offer discounts to clear out seasonal items can strain cash flow, especially if the company does not have sufficient reserves.

In conclusion, mastering cash flow management is essential for startups to navigate the financial terrain successfully, ensuring long-term growth and stability.

FAQ Insights

How can startups improve their cash flow?

Startups can enhance cash flow by optimizing operational efficiency, negotiating better payment terms with vendors, and closely monitoring expenses.

What are some common cash flow challenges faced by startups?

Common challenges include delayed customer payments, unexpected expenses, and difficulties in securing funding during lean periods.

Why is cash flow management crucial for startup success?

Effective cash flow management ensures that startups have enough liquidity to cover operational expenses, invest in growth opportunities, and withstand financial setbacks.