Embark on a journey through the world of cash flow for small businesses, understanding its importance and impact on financial stability. Learn how effective management can lead to sustainable growth and success.

Explore the nuances of cash flow management and discover key strategies for optimizing financial health in your small business.

Introduction to Cash Flow

Cash flow in the context of small businesses refers to the movement of money in and out of a business. It is essential to monitor cash flow as it provides a clear picture of a company’s financial health and liquidity. Positive cash flow indicates that a business is generating more money than it is spending, while negative cash flow means the opposite.

Importance of Monitoring Cash Flow

Monitoring cash flow is crucial for small businesses to ensure they have enough funds to cover expenses, pay employees, invest in growth opportunities, and handle unexpected costs. Without proper cash flow management, a business may face cash shortages, inability to meet financial obligations, and even bankruptcy.

- Positive Cash Flow Scenario: When a business has consistent positive cash flow, it can reinvest profits, expand operations, pay off debts, and build a financial cushion for future downturns.

- Negative Cash Flow Scenario: On the other hand, negative cash flow can lead to difficulties in paying bills, late payments to suppliers, missed opportunities for growth, and ultimately business failure.

Importance of Cash Flow Management

Effective cash flow management is crucial for the success of small businesses. It involves monitoring, analyzing, and optimizing the flow of cash in and out of the business to ensure there is enough liquidity to meet financial obligations.Poor cash flow management can have detrimental effects on small businesses. It can lead to cash shortages, missed opportunities for growth, inability to pay bills on time, damaged relationships with suppliers, and ultimately, business failure.

Strategies for Improving Cash Flow Management

Implementing the following strategies can help small businesses improve their cash flow management:

- Monitor Cash Flow Regularly: Keep track of income and expenses on a daily, weekly, and monthly basis to identify patterns and anticipate any potential cash flow issues.

- Manage Accounts Receivable: Ensure timely and efficient collection of payments from customers by establishing clear credit terms, sending timely invoices, and following up on overdue accounts.

- Negotiate Terms with Suppliers: Explore opportunities to extend payment terms with suppliers without incurring additional costs to improve cash flow.

- Control Inventory Levels: Avoid overstocking inventory to free up cash that is tied up in excess stock and optimize inventory turnover.

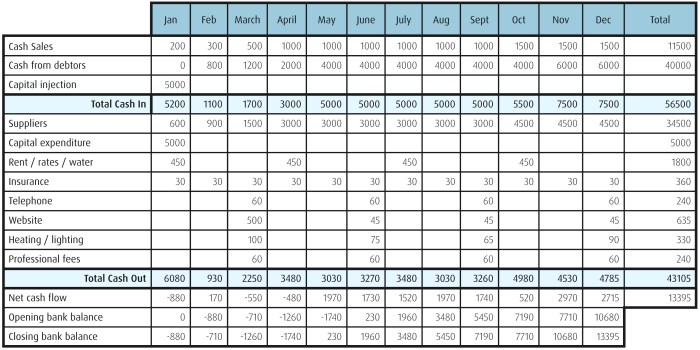

- Create a Cash Flow Forecast: Develop a cash flow forecast to predict future cash inflows and outflows, enabling better planning and decision-making.

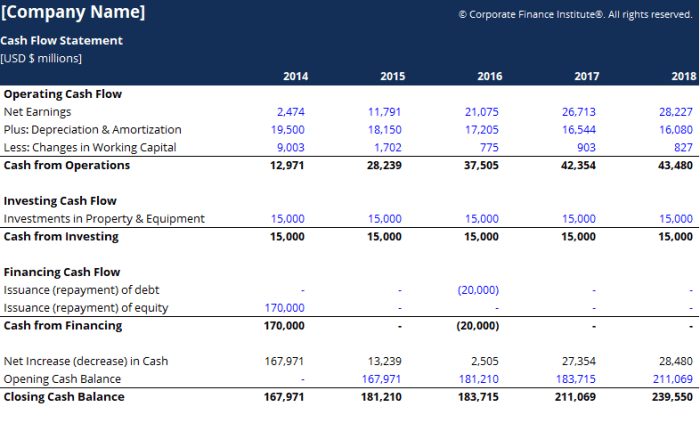

Cash Flow Statement

A cash flow statement is a financial statement that shows the inflows and outflows of cash and cash equivalents in a business over a specific period of time. It helps in analyzing the liquidity and financial health of a company by providing insights into how cash is being generated and used.

Cash Flow from Operating Activities

Cash flow from operating activities includes cash transactions from the primary business activities of a company. This section typically includes cash receipts from sales, payments to suppliers, salaries, and other operating expenses. For example, receiving cash from customers for services provided would be a typical transaction in this section.

Cash Flow from Investing Activities

Cash flow from investing activities includes cash transactions related to the purchase and sale of long-term assets, such as property, plant, and equipment. This section also covers investments in securities and other financial instruments. An example of a transaction in this section would be the purchase of new machinery for the business.

Cash Flow from Financing Activities

Cash flow from financing activities includes cash transactions related to the company’s capital structure, such as issuing or repurchasing stock, issuing or repaying debt, and payment of dividends. A typical transaction in this section would be the repayment of a bank loan taken to finance business operations.

Factors Affecting Cash Flow

Managing cash flow in small businesses can be challenging due to various factors that can influence the inflow and outflow of funds. It is crucial to understand these factors to effectively plan and maintain a healthy cash flow.

Seasonal Effects

Seasonal fluctuations can significantly impact cash flow in small businesses, especially those that experience peak seasons. During busy periods, there may be higher sales and revenue, leading to increased cash inflow. However, off-peak seasons can result in lower sales and cash flow challenges. To mitigate the negative impacts of seasonal effects, businesses can implement strategies such as budgeting for lean months, offering promotions to boost sales during slow periods, and negotiating flexible payment terms with suppliers.

Payment Terms

The payment terms established with customers and suppliers can influence cash flow. Longer payment terms from customers can delay cash inflow, affecting the business’s ability to meet immediate financial obligations. On the other hand, negotiating favorable payment terms with suppliers can help in managing cash flow effectively. Businesses can address this by incentivizing early payments from customers, implementing stricter credit policies, and negotiating mutually beneficial payment terms with suppliers.

Economic Conditions

Economic conditions, such as recessions or economic downturns, can have a significant impact on cash flow in small businesses. Reduced consumer spending, inflation, or changes in interest rates can affect sales, pricing, and overall financial stability. To navigate through challenging economic conditions, businesses can focus on cost-saving measures, diversifying revenue streams, and strengthening relationships with customers to maintain cash flow stability.

Cash Flow Forecasting

Cash flow forecasting is the process of estimating the amount of cash that will flow in and out of a business within a certain period. It is a crucial aspect of financial planning for small businesses as it helps in anticipating future cash needs and ensuring smooth operations.

Methods and Tools for Cash Flow Forecasting

There are various methods and tools available for forecasting cash flow, such as:

- Direct Method: Involves estimating cash receipts and payments based on past data and current trends.

- Indirect Method: Utilizes the income statement and balance sheet to predict cash flow.

- Cash Flow Forecasting Software: Specialized tools that automate the process and provide accurate predictions.

Tips for Creating an Accurate Cash Flow Forecast

Creating an accurate cash flow forecast is essential for small businesses to make informed decisions. Here are some tips to improve the accuracy of your cash flow forecast:

- Regularly update your forecast with actual data to reflect any changes in your business.

- Consider different scenarios and variables that could impact your cash flow, such as seasonality or economic conditions.

- Involve key stakeholders in the forecasting process to gain valuable insights and perspectives.

- Use historical data and trends as a basis for your forecast, but also factor in any upcoming events or changes in the market.

- Review and analyze your forecast regularly to identify any discrepancies or areas for improvement.

In conclusion, mastering cash flow is essential for the longevity and prosperity of small businesses. By implementing sound financial practices and staying vigilant, you can navigate the financial landscape with confidence and achieve your business goals.

Detailed FAQs

How can I improve my small business’s cash flow?

To enhance cash flow, consider negotiating better payment terms with suppliers, monitoring expenses closely, and implementing efficient invoicing and collection processes.

What are the common mistakes to avoid in cash flow management?

Avoid mixing personal and business finances, neglecting to forecast cash flow, and overlooking the impact of seasonality on cash flow.