Delve into the intricate world of cash flow cycles, where the heartbeat of financial operations is revealed through a lens of clarity and insight.

Explore the key elements that drive the financial engine of businesses and the significance of mastering this essential aspect of financial management.

Cash Flow Cycle

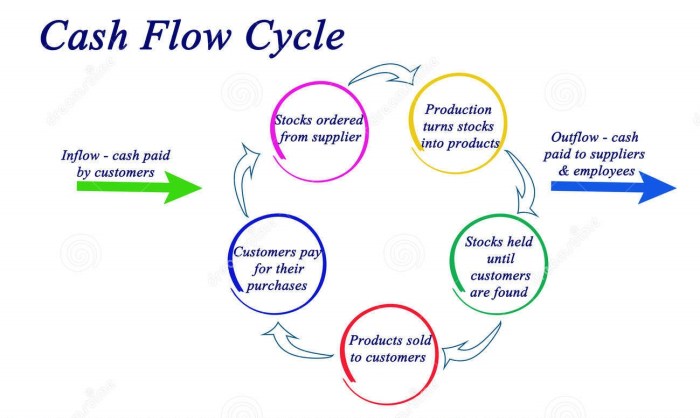

The cash flow cycle is the process of how cash moves in and out of a business over a specific period, typically a month or a year. It involves the inflow of cash from various sources like sales, investments, or loans, and the outflow of cash to cover expenses, payments, and investments.

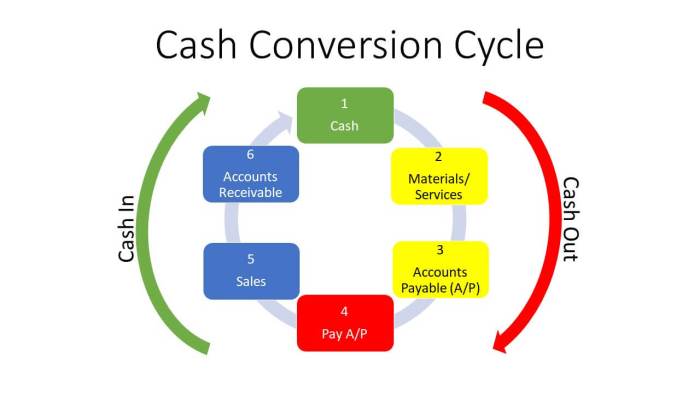

Components of a Cash Flow Cycle

- Income Generation: This is the first stage where a business earns revenue from its products or services.

- Accounts Receivable: The next stage involves collecting payments from customers who have purchased goods or services on credit.

- Accounts Payable: In this stage, the business pays its suppliers and vendors for goods and services purchased on credit.

- Operating Expenses: These are the day-to-day costs incurred to run the business, such as rent, utilities, and salaries.

- Investments: Businesses may also invest excess cash in ventures to generate additional income.

- Debt Repayment: If the business has borrowed money, it needs to repay the principal amount along with interest.

Importance of Understanding the Cash Flow Cycle for Businesses

Understanding the cash flow cycle is crucial for businesses as it helps in managing finances effectively and ensuring the smooth operation of the business. By analyzing the cash flow cycle, businesses can:

- Identify potential cash shortages and take proactive measures to address them.

- Plan for upcoming expenses and investments based on the cash flow projections.

- Optimize cash flow by streamlining receivables and payables processes.

- Evaluate the need for external financing or additional investment based on cash flow trends.

- Make informed decisions about pricing, production, and expansion strategies to maintain a healthy cash flow.

Cash Flow

Cash flow in the context of business finance refers to the movement of money in and out of a business over a specific period of time. It is a crucial measure of a company’s financial health and sustainability, as it indicates the ability to pay bills, invest in growth opportunities, and meet financial obligations.

Difference Between Cash Flow and Profit

While profit is the total revenue generated minus expenses incurred during a specific period, cash flow focuses on the actual cash that flows in and out of the business. Profit is a measure of the company’s performance, whereas cash flow reflects the liquidity and financial flexibility of the business.

Positive Cash Flow Impact

Positive cash flow has a significant impact on a business’s operations by ensuring that there is enough cash on hand to cover expenses, invest in new projects, repay debts, and seize growth opportunities. It provides the financial stability needed to navigate through economic downturns, unexpected expenses, and market fluctuations.

In conclusion, the cash flow cycle stands as a pivotal force shaping the success and stability of businesses, underscoring the critical need for a deep understanding of its mechanisms.

Essential Questionnaire

What is the cash flow cycle?

The cash flow cycle refers to the movement of funds in and out of a business, encompassing the various stages of cash inflow and outflow.

How does positive cash flow impact a business?

Positive cash flow enhances a business’s liquidity, ensuring it has the necessary funds to meet its financial obligations and invest in growth opportunities.

What differentiates cash flow from profit?

Cash flow represents the actual cash generated and spent by a business, while profit is the difference between revenue and expenses, which may not directly correlate with cash movements.