Cash Flow Forecasting sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the realm of business finance, understanding and managing cash flow is paramount to success. Let’s delve into the intricacies of Cash Flow Forecasting and discover its crucial role in financial planning.

CASH FLOW

Cash flow in a business refers to the movement of money in and out of the company. It represents the amount of cash and cash equivalents being transferred into and out of a business during a specific period of time.

Importance of Managing Cash Flow

Effectively managing cash flow is crucial for the financial health and sustainability of a business. It ensures that the company has enough liquidity to cover its expenses, invest in growth opportunities, and meet its financial obligations.

- Prevents insolvency: By monitoring cash flow, businesses can avoid situations where they run out of cash and are unable to pay their bills or debts.

- Supports growth: Proper cash flow management allows businesses to seize growth opportunities by having the necessary funds available for investments and expansion.

- Enhances decision-making: Understanding cash flow patterns helps in making informed decisions regarding budgeting, pricing strategies, and financial planning.

Difference between Cash Flow and Profits

While cash flow and profits are related, they are not the same. Profits represent the revenue earned minus expenses incurred, which is recorded on the income statement. On the other hand, cash flow focuses on the actual cash movements within the business.

- Cash flow can be positive even when a company is experiencing losses, as it considers cash transactions rather than accounting principles.

- Profits can be influenced by non-cash items such as depreciation, which do not impact cash flow directly.

- Cash flow provides a more accurate picture of a company’s financial health in terms of liquidity and ability to meet short-term obligations.

CASH FLOW FORECASTING

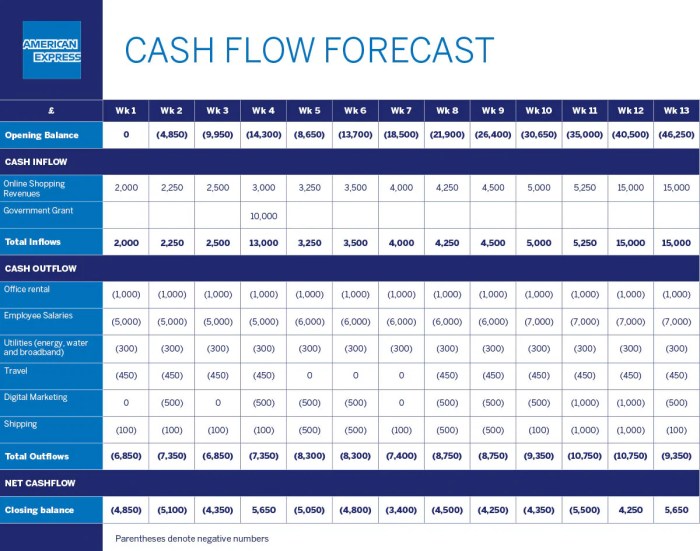

Cash flow forecasting is a crucial aspect of financial planning that involves estimating the amount of cash that will flow in and out of a business over a specific period. It helps businesses predict their future financial position, make informed decisions, and plan for potential cash shortages or surpluses.Creating a cash flow forecast typically involves analyzing historical cash flow data, considering upcoming expenses and revenues, and taking into account any anticipated changes in the business environment.

By accurately forecasting cash flow, businesses can better manage their working capital, identify areas for cost savings, and ensure they have enough liquidity to meet their financial obligations.

Short-term vs. Long-term Cash Flow Forecasting Methods

Short-term cash flow forecasting focuses on predicting cash flows over a shorter time horizon, usually up to one year. It involves detailed analysis of immediate cash requirements, such as payroll, utility bills, and inventory purchases. Short-term forecasts are essential for day-to-day cash management and ensuring that the business has enough cash on hand to cover its short-term obligations.On the other hand, long-term cash flow forecasting looks further into the future, typically beyond one year.

This type of forecasting considers factors like long-term investments, loan repayments, and potential growth opportunities. Long-term forecasts help businesses plan for major expenditures, assess their overall financial health, and make strategic decisions to support sustainable growth.Overall, both short-term and long-term cash flow forecasting methods play a crucial role in financial planning by providing businesses with valuable insights into their cash position, helping them make informed decisions, and ensuring financial stability in the long run.

COMPONENTS OF CASH FLOW FORECASTING

Cash flow forecasting involves several key components that are crucial for accurately predicting the inflows and outflows of cash within a business. These components include sales projections, expenses, and investments.

Sales Projections Impact

Sales projections play a significant role in cash flow forecasting as they provide an estimate of the revenue that a business expects to generate over a specific period. These projections are essential for determining the amount of cash that will be coming into the business, which directly impacts the overall cash flow. By analyzing historical sales data, market trends, and other relevant factors, businesses can make informed sales projections that are vital for forecasting cash flow accurately.

Expenses and Investments

Expenses and investments are another essential component of cash flow forecasting. Expenses refer to the costs incurred by a business to operate, such as rent, utilities, salaries, and supplies. By accurately estimating these expenses, businesses can predict the outflows of cash and plan accordingly to ensure they have enough liquidity to cover these costs. On the other hand, investments represent the capital expenditures made by a business, such as purchasing equipment, expanding facilities, or investing in new projects.

Properly forecasting investments is crucial for understanding how these expenditures will impact cash flow in the future and ensuring that the business has the necessary funds to support growth and development.

TOOLS AND SOFTWARE

Cash flow forecasting can be a complex process, but with the right tools and software, businesses can streamline this crucial aspect of financial planning. Here, we will explore some popular tools and software used for cash flow forecasting, compare different options available, and analyze how these tools can enhance the forecasting process.

Popular Tools and Software for Cash Flow Forecasting

- QuickBooks: A widely used accounting software that offers cash flow forecasting tools to help businesses predict their financial future.

- Xero: Another popular accounting software that provides cash flow forecasting features, allowing users to create accurate projections.

- Sage Intacct: This cloud-based accounting software includes robust cash flow forecasting capabilities to help businesses make informed decisions.

- Float: A cash flow forecasting software specifically designed to streamline the process and provide real-time insights into cash flow management.

Comparison of Different Software Options

- QuickBooks vs. Xero: Both platforms offer cash flow forecasting tools, but QuickBooks is known for its user-friendly interface, while Xero is praised for its advanced reporting capabilities.

- Sage Intacct vs. Float: While Sage Intacct is a comprehensive accounting software with cash flow forecasting features, Float specializes in real-time cash flow insights and scenario planning.

Streamlining the Forecasting Process

Utilizing these tools and software can streamline the cash flow forecasting process in several ways. They can automate data entry, provide visual representations of cash flow trends, offer scenario planning capabilities, and generate accurate projections based on historical data. By integrating these tools into their financial planning processes, businesses can make informed decisions and ensure financial stability.

In conclusion, Cash Flow Forecasting is not just about predicting numbers; it’s about shaping the future of a business by making informed decisions. By mastering the art of forecasting cash flow, businesses can navigate challenges, seize opportunities, and pave the way for sustainable growth. Embrace the power of Cash Flow Forecasting and unlock the potential for financial success.

Q&A

How does cash flow forecasting differ from profit forecasting?

Cash flow forecasting focuses on the actual movement of cash in and out of a business, while profit forecasting deals with expected revenues and expenses.

What are the key components typically included in a cash flow forecast?

The key components usually include projected sales, expenses, investments, and any other sources of cash inflow or outflow.

Why is managing cash flow effectively important for businesses?

Effective cash flow management ensures that a business has enough liquidity to cover its expenses, debts, and investments, ultimately leading to financial stability and growth.