Delve into the realm of cash flow with a clear focus on its definition, significance, and real-life implications for businesses. Let’s uncover the essence of managing cash flow effectively.

Explore the different types of cash flow, dissect the components of a cash flow statement, and discover essential strategies for optimizing cash flow management.

What is Cash Flow?

Cash flow in the context of business finance refers to the movement of money in and out of a business. It includes all the money coming into the business from various sources (such as sales revenue, investments, and loans) and all the money going out of the business to cover expenses (like rent, salaries, and supplies).Understanding cash flow is crucial for businesses because it helps in assessing the liquidity and financial health of the company.

Positive cash flow indicates that a business is generating more money than it’s spending, which is essential for covering operational costs, investing in growth opportunities, and fulfilling financial obligations. On the other hand, negative cash flow means that a business is spending more money than it’s earning, which can lead to financial difficulties, debt accumulation, and potential bankruptcy.Examples of positive cash flow scenarios include consistent sales revenue exceeding expenses, efficient management of accounts receivable and payable, and successful investment returns.

Conversely, negative cash flow scenarios can arise from high overhead costs, slow-paying customers, unexpected expenses, or declining sales.It’s important to note that cash flow differs from profit. While profit represents the difference between revenue and expenses over a specific period, cash flow focuses on the actual movement of cash in and out of the business regardless of when it’s earned or spent.

A business can be profitable but still face cash flow challenges if there’s a delay in receiving payments or managing cash effectively.

Cash Flow Management

Effective cash flow management is essential for businesses to maintain financial stability and support growth. It involves monitoring cash flow projections, optimizing cash inflows and outflows, managing working capital efficiently, and preparing for potential cash flow disruptions. By implementing sound cash flow management practices, businesses can enhance their financial resilience and seize opportunities for expansion and innovation.

Types of Cash Flow

Understanding the different types of cash flow is essential for managing the financial health of a business.

Operating Cash Flow

Operating cash flow refers to the cash generated from a company’s core business activities. It includes revenue from sales of goods or services and expenses related to those activities.

- Example: A retail store receives cash from customers purchasing products and pays cash for inventory and employee salaries.

- Contribution to overall cash flow: Positive operating cash flow indicates that a company is able to sustain its operations and cover day-to-day expenses.

Investing Cash Flow

Investing cash flow involves cash transactions related to the purchase or sale of long-term assets or investments.

- Example: A company buys new equipment for production or sells an investment in another business.

- Contribution to overall cash flow: Investing cash flow reflects the company’s growth and expansion strategies, as well as its ability to invest in future opportunities.

Financing Cash Flow

Financing cash flow represents cash transactions related to the company’s capital structure, such as equity or debt financing.

- Example: Issuing new shares of stock to raise capital or repaying a bank loan.

- Contribution to overall cash flow: Financing cash flow shows how a company funds its operations and investments, as well as its ability to manage debt and equity effectively.

Cash Flow Statement

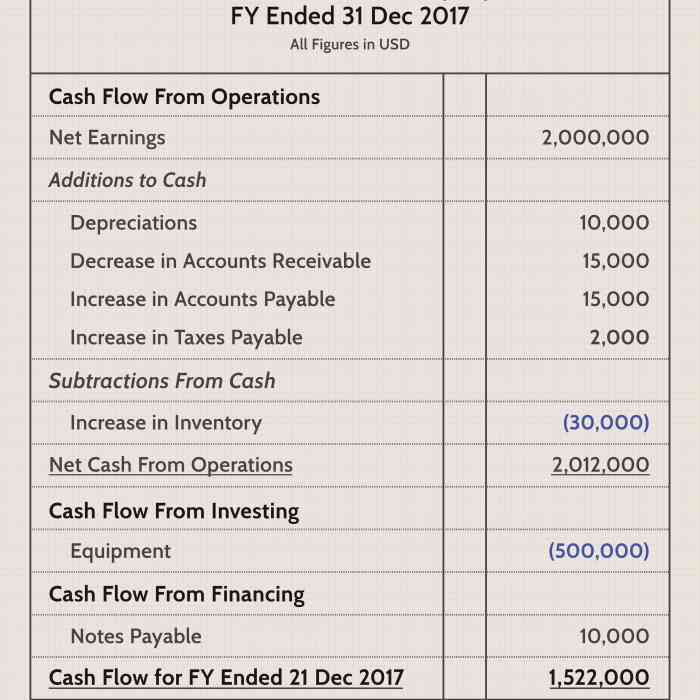

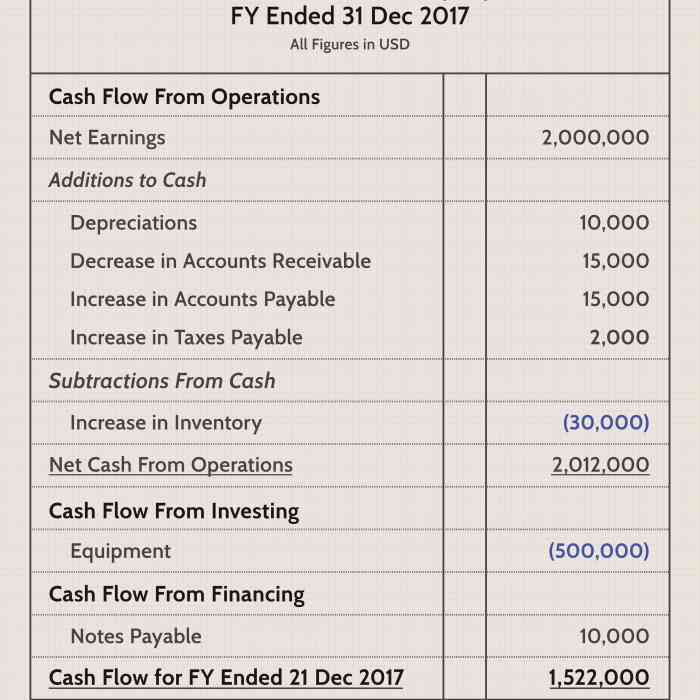

The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company during a specific period. It helps in analyzing how well a company manages its cash position, liquidity, and overall financial health.

Purpose and Components of a Cash Flow Statement

A cash flow statement consists of three main components: operating activities, investing activities, and financing activities. These sections help to categorize the cash flows and show where the money is coming from and where it is going.

- Operating Activities: This section includes cash flows from the primary business operations of the company, such as revenue and expenses.

- Investing Activities: This section includes cash flows from the purchase and sale of long-term assets, such as property, plant, and equipment.

- Financing Activities: This section includes cash flows from activities related to the company’s capital structure, such as issuing or repurchasing shares, and borrowing or repaying debt.

How a Cash Flow Statement Helps in Analyzing a Company’s Financial Health

By examining a company’s cash flow statement, investors and analysts can evaluate the company’s ability to generate cash, its liquidity position, and its overall financial stability. A positive cash flow from operating activities is generally seen as a good sign, as it indicates that the company is generating enough cash to support its operations.

Step-by-Step Guide on How to Create a Cash Flow Statement

Creating a cash flow statement involves analyzing the cash inflows and outflows from various activities of the company during a specific period. Here is a basic step-by-step guide to create a cash flow statement:

- Start with the opening balance of cash at the beginning of the period.

- Calculate the cash inflows and outflows from operating activities, investing activities, and financing activities.

- Summarize the total cash inflows and outflows for each activity.

- Calculate the net cash flow by subtracting the total cash outflows from the total cash inflows.

- End with the closing balance of cash at the end of the period.

Significance of Cash Flow Statement Analysis for Investors

Analyzing a company’s cash flow statement is crucial for investors as it provides insights into the company’s financial health and its ability to generate cash. Investors can use the information from the cash flow statement to assess the company’s liquidity, solvency, and overall financial performance. By understanding the cash flow dynamics of a company, investors can make informed decisions about investing in or divesting from the company’s stock.

Managing Cash Flow

Effective cash flow management is crucial for the financial health and sustainability of a business. By implementing strategies to improve cash flow, forecasting future cash flows, and utilizing tools to monitor and control cash flow effectively, businesses can ensure they have enough liquidity to cover expenses and invest in growth.

Strategies for Improving Cash Flow

- Offering discounts for early payments to incentivize customers to pay sooner.

- Negotiating better payment terms with suppliers to extend payment deadlines.

- Reducing unnecessary expenses to free up cash for essential operations.

- Regularly reviewing and optimizing pricing strategies to maximize revenue.

Importance of Forecasting Cash Flow

Forecasting cash flow is essential for business planning as it helps in anticipating cash shortages or surpluses. By forecasting cash flow, businesses can make informed decisions on investments, expansion, and managing working capital to ensure financial stability.

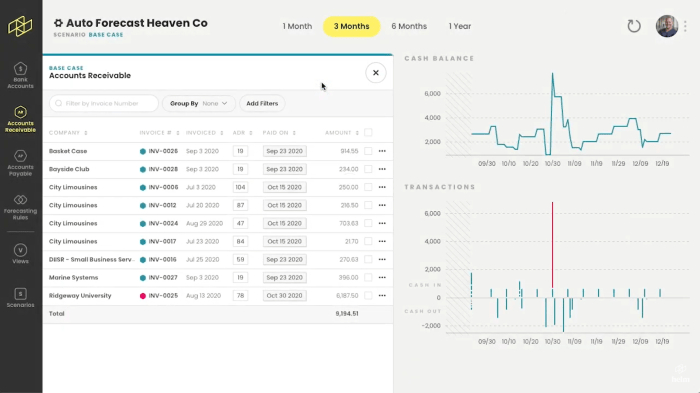

Tools and Techniques for Monitoring and Controlling Cash Flow

- Using accounting software to track income and expenses in real-time.

- Creating cash flow statements regularly to analyze cash movements.

- Implementing cash flow budgets to plan and manage cash inflows and outflows.

- Utilizing cash flow ratios to assess liquidity and financial health.

Successful Cash Flow Management Practices

One real-life example of successful cash flow management is Apple Inc., which strategically manages its cash reserves to fund research and development, acquisitions, and dividends. By maintaining a strong cash position, Apple can navigate economic uncertainties and invest in innovation while ensuring financial stability.

In conclusion, grasping the concept of cash flow is crucial for sustainable business growth. By mastering the art of cash flow management, businesses can navigate financial challenges with confidence and foresight.

Key Questions Answered

What are the key components of a cash flow statement?

The key components include operating activities, investing activities, and financing activities that showcase how cash moves in and out of a business.

How does cash flow differ from profit?

Cash flow represents the actual inflow and outflow of cash, while profit is a measure of income that includes non-cash items.

Why is forecasting cash flow important for businesses?

Forecasting cash flow helps businesses anticipate financial needs, identify potential challenges, and make informed decisions to ensure financial stability.