Embarking on the journey of managing cash flow during a crisis, this article delves into essential strategies and tools to navigate turbulent times with financial finesse.

Exploring the nuances of cash flow management and its critical role in sustaining business operations during challenging periods

Understanding Cash Flow

Cash flow is the movement of money in and out of a business, representing the amount of cash being generated and spent over a specific period. It is crucial for the financial health of a company as it determines its ability to pay bills, salaries, and other expenses.

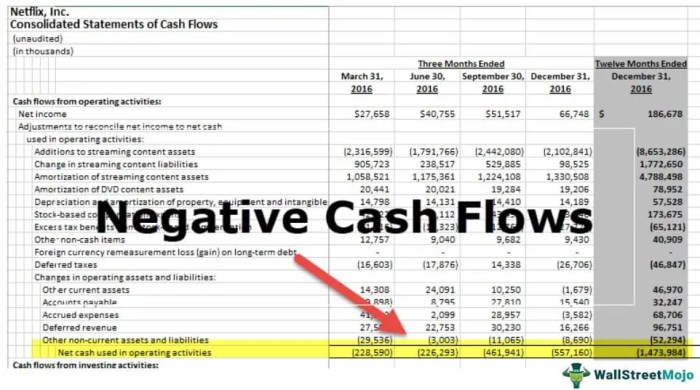

Positive cash flow occurs when the incoming cash exceeds the outgoing cash, indicating that the business is generating more money than it is spending. On the other hand, negative cash flow occurs when the outgoing cash surpasses the incoming cash, signaling potential financial trouble for the company.

Impact of Cash Flow During a Crisis

- During a crisis, such as a pandemic or economic downturn, cash flow becomes even more critical as businesses may experience disruptions in their revenue streams.

- Companies with positive cash flow have a better cushion to weather the storm, enabling them to continue operations and meet financial obligations even in challenging times.

- On the contrary, businesses with negative cash flow may struggle to cover essential expenses, leading to cash shortages, missed payments, and ultimately, financial distress.

Strategies for Managing Cash Flow

During a crisis, it is crucial for businesses to implement effective strategies to manage their cash flow. This involves forecasting cash flow, reducing expenses, and renegotiating payment terms with suppliers.

Forecasting Cash Flow

Forecasting cash flow is essential during a crisis as it helps businesses anticipate their financial position and plan accordingly. By analyzing past data, current trends, and potential scenarios, companies can make informed decisions to ensure sufficient liquidity.

Techniques for Reducing Expenses

- Identify non-essential expenses and cut back on discretionary spending.

- Negotiate with vendors for better pricing or discounts on products and services.

- Implement cost-saving measures such as energy efficiency programs or remote working to reduce operational costs.

Renegotiating Payment Terms with Suppliers

Renegotiating payment terms with suppliers can help businesses manage cash flow by extending payment deadlines or negotiating lower prices. By maintaining open communication and building strong relationships with suppliers, companies can find mutually beneficial solutions to improve their financial stability.

Cash Flow Management Tools

When it comes to managing cash flow effectively, there are various tools and software available to assist businesses in monitoring and analyzing their financial situation. These tools can provide valuable insights and help in making informed decisions to ensure the financial health of the company.

Popular Cash Flow Management Tools

- QuickBooks: This popular accounting software offers features for tracking income and expenses, invoicing, and generating financial reports to help businesses manage their cash flow efficiently.

- Xero: Another cloud-based accounting software that provides real-time visibility into cash flow, allowing businesses to track payments, reconcile accounts, and manage expenses seamlessly.

- Wave: A free accounting software that offers tools for invoicing, receipt scanning, and expense tracking, helping small businesses keep a close eye on their cash flow.

Comparison of Cash Flow Management Tools

| Tool | Key Features | Benefits |

|---|---|---|

| QuickBooks | Income/Expense Tracking, Invoicing, Financial Reports | Comprehensive financial management, Easy to use |

| Xero | Real-time Cash Flow Monitoring, Account Reconciliation | Cloud-based accessibility, Integration with other software |

| Wave | Invoicing, Receipt Scanning, Expense Tracking | Free to use, Suitable for small businesses |

Benefits of Automated Cash Flow Management Systems

- Efficiency: Automated systems can streamline financial processes, saving time and reducing manual errors in cash flow management.

- Accuracy: By automating cash flow monitoring and analysis, businesses can ensure accurate financial data for better decision-making.

- Visibility: Automated tools provide real-time visibility into cash flow, allowing businesses to identify trends and potential issues promptly.

In conclusion, mastering the art of managing cash flow during crises is vital for business resilience and long-term success. Implementing the discussed strategies and utilizing the recommended tools can pave the way for financial stability in uncertain times.

Commonly Asked Questions

What is the importance of forecasting cash flow during a crisis?

Forecasting cash flow helps businesses anticipate financial challenges and plan for resource allocation effectively.

How can renegotiating payment terms with suppliers assist in managing cash flow?

Renegotiating payment terms with suppliers can provide businesses with extended payment deadlines, easing immediate financial burdens.

What are the benefits of using automated cash flow management systems?

Automated cash flow management systems offer real-time insights, streamline financial processes, and enhance overall efficiency in tracking and managing cash flow.